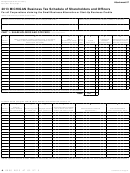

Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 9

ADVERTISEMENT

MEGA also may provide that qualified sales to a qualified

Line 76: Approved businesses receive a certificate from

customer not be considered in calculating the sales factor for

MEGA each year showing the total amount of tax credit

allowed. Attach the Anchor District Tax Credit Certificate to

the tax year for which a credit is provided.

the return. (If the certificate is not attached, the credit will be

The statute provides for reduction, termination, or recapture of

disallowed.)

the credit if the taxpayer fails to comply with its agreement or

the statute. Credit recapture is calculated on Form 4587.

Line 79: Add lines 75 and 78b. This amount is the Anchor

Company Taxable Value credit carryforward to be used on the

For more information, contact MEDC at (517) 373-9808 or visit

taxpayer’s next MBT return.

the MEDC Web site at

MEGA Poly-Silicon Energy Cost Credit and

Line 65: UBGs: Enter unused credit amount from Form 4580,

Miscellaneous MEGA Battery Credits

Part 2B, line 58, column C.

Beginning January 1, 2012, these credits are available as

Line 68: Approved businesses receive a certificate from

certificated credits to the extent that the taxpayer has entered

MEGA each year showing the total amount of tax credit

allowed. Attach the Anchor Jobs Tax Credit Certificate to the

into an agreement with MEGA by December 31, 2011, but

the credit has not been fully claimed or paid prior to January

return. (If the certificate is not attached, the credit will be

1, 2012.

This credit must be claimed beginning with the

disallowed.)

taxpayer’s first tax year ending after December 31, 2011, in

Line 71: Add lines 67 and 70b. This amount is the Anchor

order for the taxpayer to remain taxable under the MBT and

Company Payroll credit carryforward to be used on the

claim the credit. This credit cannot be claimed for a tax

taxpayer’s next MBT return.

period ending in 2015 or later.

Anchor Company Taxable Value Credit

Line 81a-f: Enter unused credit amount from a previous period

MBT return for the appropriate credit.

The Anchor Company Taxable Value Credit is available for a

qualified taxpayer that was designated by MEGA as an anchor

UBGs: Enter the unused credit amount from Form 4580, Part

company within the last five years and that has influenced a

2B, for the appropriate credit.

new qualified supplier or customer to open, locate, or expand

Line 81a-f: Enter unused credit amount from a previous period

in Michigan.

MBT return for the appropriate credit.

Beginning January 1, 2012, this credit is available as a

Line 84a-f: Approved businesses receive a certificate from

certificated credit to the extent that the taxpayer has entered

MEGA each year showing the total amount of tax credit

into an agreement with MEGA by December 31, 2011, but

allowed. Attach the certificate to the return. (If the certificate

the credit has not been fully claimed or paid prior to January

is not attached, the credit will be disallowed.)

1, 2012.

This credit must be claimed beginning with the

taxpayer’s first tax year ending after December 31, 2011, in

Line 87: Add lines 83 and 86b. This amount is the MEGA

order for the taxpayer to remain taxable under the MBT and

Poly-Silicon Energy Cost Credit and/or Miscellaneous MEGA

claimed the credit.

Battery Credits carryforward to be used on the taxpayer’s next

MBT return.

A qualified taxpayer may take a credit in an amount up to 5

percent of its supplier’s or customer’s taxable property value

NOTE: The MEGA battery manufacturing facility credit now

within a ten mile radius of the qualified taxpayer. This credit

has a limited accelerated option. For more information on

may be taken for a period of up to five years, as determined

accelerated certificated credits, see Form 4589.

by MEGA. Any amount that exceeds the taxpayer’s tax liability

Include completed Form 4584 as part of the tax return filing.

may be refunded or carried forward for five years or until it is

used up, whichever occurs first. To be eligible for the credit, a

taxpayer must be certified by MEGA. MEGA also may provide

that qualified sales to a qualified customer not be considered in

calculating the sales factor for the tax year for which a credit is

provided.

The statute provides for reduction, termination, or recapture

of the credit if the taxpayer fails to comply with its agreement

or the statute. Credit recapture is calculated on the MBT

Schedule of Recapture of Certain Business Credits and

Deductions (Form 4587). For more information, contact the

MEDC at (517) 373-9808 or visit the MEDC Web site at

Line 73: Enter unused credit amount from a previous period

MBT return.

UBGs: Enter the unused credit amount from Form 4580, Part

2B, line 59, column C.

141

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9