Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 4

ADVERTISEMENT

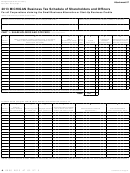

4584, Page 4

FEIN or TR Number

MEGA POLY-SILICON ENERGY COST CREDIT AND MISCELLANEOUS MEGA BATTERY CREDITS —

See Instructions

Lines 81 through 88 calculate the following credits: MEGA Poly-Silicon Energy Cost Credit; MEGA Plug-In Traction Battery Integration Credit; MEGA

Advanced Battery Engineering Credit; MEGA Battery Manufacturing Facility Credit; MEGA Large Scale Battery Credit; and MEGA Advanced Lithium Ion

Battery Credit. If claiming multiple credits, see instructions.

81. Unused credit from previous period MBT return.

a. Unused MEGA Poly-Silicon Energy Cost Credit.......................................... 81a.

00

b. Unused MEGA Plug-In Traction Battery Integration Credit......................... 81b.

00

c. Unused MEGA Advanced Battery Engineering Credit ................................. 81c.

00

d. Unused MEGA Battery Manufacturing Facility Credit .................................. 81d.

00

e. Unused MEGA Large Scale Battery Credit.................................................. 81e.

00

f. Unused MEGA Advanced Lithium Ion Battery Credit .................................. 81f.

00

g. Total of all unused credits. Add lines 81a through 81f ....................................................................................... 81g.

00

82. Tax After Previous Period Credit. Subtract line 81g from line 77. If less than zero, enter zero ..............................

00

82.

83. Remaining unused credit from previous period MBT return. If line 81g is

greater than line 77, enter the difference ..........................................................

00

83.

84. Available credit from the MEDC Certificate (attach).

a. MEGA Poly-Silicon Energy Cost Credit ....................................................... 84a.

00

b. MEGA Plug-In Traction Battery Integration Credit ...................................... 84b.

00

c. MEGA Advanced Battery Engineering Credit .............................................. 84c.

00

d. MEGA Battery Manufacturing Facility Credit ............................................... 84d.

00

e. MEGA Large Scale Battery Credit ............................................................... 84e.

00

f. MEGA Advanced Lithium Ion Battery Credit ................................................ 84f.

00

g. Total of all available credits. Add lines 84a through 84f ..................................................................................... 84g.

00

85. Tax After Current Period Credit. Subtract line 84g from line 82. If less than zero, enter zero here and complete

line 86; Otherwise, skip to line 87 ...........................................................................................................................

00

85.

86. If line 84g is greater than line 82, elect a refund or carryforward of credit by entering the difference on either

line 86a or line 86b.

a. Refundable Amount. Carry amount to Form 4574, line 22 .......................... 86a.

00

b. Carryforward Amount................................................................................... 86b.

00

87. Total Credit Carryforward. Add lines 83 and 86b ..............................................

00

87.

88. MEGA Poly-Silicon Energy Cost Credit and Miscellaneous MEGA

Battery Credit. Subtract line 85 from line 77. Carry amount to Form 4573,

00

line 81 ...............................................................................................................

88.

+

0000 2014 71 04 27 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9