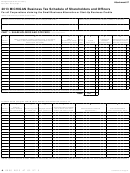

Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 6

ADVERTISEMENT

A qualified MBT taxpayer may take one of two additional

enhanced credit issued after December 1, 2008, is revoked;

or a historic resource is sold or disposed of less than five

credits. The Enhanced Credit is equal to a percentage of

qualified expenditures, not to exceed 15 percent, established in

years after the historic resource is placed in service during a

a preapproval letter issued by SHPO.

tax year beginning after December 31, 2008.

The Special Consideration Credit is equal to a percentage

100 percent If less than 1 year

of qualified expenditures, not to exceed 15 percent, recorded

80 percent

If at least 1 year, but less than 2 years

on the Certificate of Completion awarded by SHPO. Special

60 percent

If at least 2 years, but less than 3 years

Consideration Credits are granted to rehabilitation plans

40 percent

If at least 3 years, but less than 4 years

expected to have a high community impact and to have

significantly greater historic, social, and economic impact

20 percent

If at least 4 years, but less than 5 years

than those plans that earn Enhanced Credits. The maximum

amount of credit that may be claimed during a tax year is

If the credit has been assigned, the recapture is the

$3,000,000 per project, with the excess being carried forward

responsibility of the qualified taxpayer that received the

until used up. The Enhanced and Special Consideration

certificate of completed rehabilitation, not the assignee.

Credits are taken in addition to the Basic Credit. All three

are calculated on Michigan Historic Preservation Tax Credit

NOTE: A recapture is not required if the qualified taxpayer

(Form 3581).

enters into a written agreement with SHPO that allows for the

A qualified taxpayer may assign all or a portion of its credit

transfer or sale of the historic resource.

to any assignee. The credit assignment cannot be revoked,

UBGs: If any member of the UBG is reporting recapture,

but an assignee may subsequently reassign a credit, or any

a statement must be attached to this form identifying the

portion of an assigned credit, to one or more assignees.

reporting member.

Generally, both the initial assignment of the Michigan

Historic Preservation Tax Credit by the qualified taxpayer to

Line 4: Enter the amount of Basic/Enhanced credit carryforward

the first assignee(s) and the subsequent reassignment by the

from the prior year MBT Form 4584, if any. Available SBT

first assignee(s) to reassignee(s) must be done in the tax year

credit carryforward is claimed separately on Form 4569.

in which the certificate of completed rehabilitation is issued.

UBGs: Standard taxpayers, enter the carryforward amount

For information on assignments, contact the State Historic

from Form 4580, Part 2B, line 48, column C.

Financial

Preservation Office (SHPO).

institutions, enter the combined total of carryforward amounts

reported on the UBG Combined Filing Schedule for Financial

For Basic, Enhanced and Special Consideration credits for

which a certificate of completed rehabilitation is issued for a

Institutions (Form 4752), line 28, by all members of the group.

tax year beginning after December 31, 2007 and ending before

Line 7: Enter amount of Special Consideration credit

January 1, 2012, an assignment by a qualified taxpayer of all

carryforward from prior year MBT Form 4584, if any. The

or any portion of a credit allowed may be made within the

Special Consideration credit carryforward must be separately

12 months immediately succeeding the tax year in which the

recorded

because,

unlike

the

Basic/Enhanced

Credit

certificate of completed rehabilitation is issued.

carryforward, it may be carried forward until used up. It does

An unused carryforward of a Historic Preservation Credit

not expire after 10 years.

generated under SBT may be claimed against the tax imposed

UBGs: Standard taxpayers, enter thecarryforward amount

by MBT for the years the carryforward would have been

from Form 4580, Part 2B, line 49, column C. Financial

available under SBT (maximum ten years) if the taxpayer has

institutions, enter the combined total of carryforward amounts

made the election to remain taxable under the MBT with a

reported on Form 4752, line 29, by all members of the group.

certificated credit. This carryforward is claimed on the MBT

Line 10: Basic/Enhanced Credit. If the Historic Preservation

Single Business Tax Credit Carryforwards (Form 4569).

Credit has been assigned, include the approval letter received

Line 2: Recapture. Enter the sum of all SBT and MBT

from the Michigan Department of Treasury (Treasury) in the

Historic Preservation Credit recapture amounts. If a recapture

return. (If not attached, the credit will be disallowed.)

event occurs, in the year of the event the following percentage

NOTE: If the taxpayer assigned part, but not all, of the credit,

of the credit amount previously claimed must be added back

to the tax liability of the qualified taxpayer that received the

include here the amount of credit retained by the taxpayer. To

certificate of completed rehabilitation or preapproved letter. For

this extent the assignor is also an assignee.

tax years beginning after December 31, 2008, a recapture event

Line 13: Special Consideration Credit. If the Historic

occurs if:

Preservation Credit has been assigned, attach the approval

• A certificate of completed rehabilitation is revoked or a

letter received from Treasury to the return. (If the approval

letter is not attached, the credit will be disallowed.)

preapproval letter for an enhanced credit is revoked or a

historic resource is sold or disposed of less than five years

NOTE: If the taxpayer assigned part, but not all, of the credit,

after the historic resource is placed in service (as defined in

include here the amount of credit retained by the taxpayer. To

IRC § 47(b)(1) and related federal regulations); or

this extent the assignor is also an assignee.

• A certificate of completed rehabilitation issued after

Line 25: Add line 6 and 12. This amount is the Prior year and

December 1, 2008, is revoked; or a preapproval letter for an

138

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9