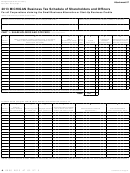

Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 8

ADVERTISEMENT

credit must be claimed beginning with the taxpayer’s first tax

program is assigned to MEGA. For more information on the

approval process, contact the MEDC at (517) 373-9808.

year ending after December 31, 2011, in order for the taxpayer to

remain taxable under the MBT and claim the credit.

Line 38: Enter tax liability before Brownfield Redevelopment

Credit from Form 4573, line 55, or Form 4596, line 19.

For tax years beginning after December 31, 2010 and ending

before January 1, 2012, the credit allowed is $500 for an

Line 39: Recapture. The disposal or transfer to another

equivalent of 4 kilowatt hours of battery capacity plus $125 for

location of personal property used to calculate this credit will

each kilowatt hour of battery capacity in excess of 4 kilowatt

result in an addition to the tax liability of the qualified taxpayer

hours of battery capacity not to exceed $2,000 for each plug-in

that was originally awarded the credit in the year in which

traction battery pack. For tax years beginning after December

the disposal or transfer occurs. This is true even if the credit

31, 2011, and ending before January 1, 2015, the credit per unit

was assigned to someone else. This additional liability will

is decreased to $375 for an equivalent of 4 kilowatt hours of

be calculated by multiplying the same percentage as is used

battery capacity plus $93.75 for each kilowatt hour of battery

to calculate the credit (e.g., 10 percent) times the federal basis

capacity in excess of 4 kilowatt hours of battery capacity not to

of the property used to calculate gain or loss [as calculated for

exceed $1,500 for each plug-in traction battery pack.

federal purposes] as of the date of the disposition or transfer.

The amount otherwise added to the tax liability may also be

A taxpayer shall not claim a credit under this section for more

used to reduce any carryforward of credits available to the

than 3 years.

taxpayer.

If the credit exceeds the tax liability of the taxpayer for the

UBGs: If any member of the UBG is reporting recapture,

tax year, the taxpayer may elect to have the excess refunded or

a statement must be attached to this form identifying the

carried forward to offset tax liability in subsequent tax years

for 10 years or until used up, whichever occurs first. Amounts

reporting member.

carried forward shall not affect the maximum amount of credits

Line 40: Enter only the unused credit from a previous period

that may be claimed in subsequent years.

MBT return. Available SBT credit carryforward is claimed

separately on Form 4569.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at

UBGs: Standard taxpayers, enter the unused credit amount

from Form 4580, Part 2B, line 54, column C. Financial

Line 57: UBGs: Enter the unused credit amount from Form

4580, Part 2B, line 57, column C.

institutions, enter the combined total of carryforward amounts

reported on Form 4752, line 31, by all members of the group.

Line 60: Approved businesses receive a certificate from

Line 43: If the Brownfield Redevelopment Credit has been

MEGA each year showing the total amount of tax credit

assigned, attach the MBT Brownfield Redevelopment Credit

allowed. Attach the certificate to the return. (If the certificate

Assignment Certificate to the return. (If the certificate is not

is not attached, the credit will be disallowed.)

attached, the credit will be disallowed.)

Line 63: Add lines 59 and 62b. This is the MEGA Plug-In

Line 46: For the credit to be valid, attach the Certificate

Traction Battery Manufacturing Credit carryforward to be used

of Completion, issued after the completion of the approval

on the taxpayer’s next MBT return.

process, to the return. (If the certificate is not attached, the

Anchor Company Payroll Credit

credit will be disallowed.)

Line 54: Add lines 51 and 53. This amount is the Brownfield

The Anchor Company Payroll Credit is available for a qualified

Redevelopment credit carryforward to be used on the

taxpayer that was designated by MEGA as an anchor company

within the last five years and that has influenced a new

taxpayer’s next MBT return.

qualified supplier or customer to open, locate, or expand in

MEGA Plug-In Traction Battery Manufacturing

Michigan. Beginning January 1, 2012, this credit is available as

Credit

a certificated credit to the extent that the taxpayer has entered

The MEGA Plug-In Traction Battery Manufacturing Credit

into an agreement with MEGA by December 31, 2011, but

the credit has not been fully claimed or paid prior to January

encourages investment in the development, manufacture,

commercialization, and affordability of advanced automotive

1, 2012.

This credit must be claimed beginning with the

taxpayer’s first tax year ending after December 31, 2011, in

high-power energy batteries. The credit is available only to a

taxpayer that has entered into an agreement with MEGA that

order for the taxpayer to remain taxable under the MBT and

provides that the taxpayer will manufacture plug-in traction

claim the credit.

battery packs in Michigan. The taxpayer must attach the

A qualified taxpayer may take a credit up to 100 percent of its

MEGA certificate to the MBT annual return on which the

supplier’s or customer’s payroll for employees who perform

credit is claimed. This credit cannot be claimed for a tax

qualified new jobs multiplied by the Michigan Individual

period ending in 2015 or later.

Income Tax rate. This credit may be taken for a period of up to

Beginning January 1, 2012, this credit is available as a

five years, as determined by MEGA. Any amount that exceeds

certificated credit to the extent that the taxpayer has entered into

the taxpayer’s tax liability may be refunded or carried forward

for ten years or until it is used up, whichever occurs first. To be

an agreement with MEGA by December 31, 2011, but the credit

has not been fully claimed or paid prior to January 1, 2012. This

eligible for the credit, a taxpayer must be certified by MEGA.

140

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9