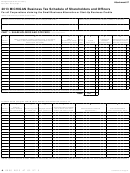

Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014 Page 7

ADVERTISEMENT

Beginning January 1, 2012, the brownfield redevelopment

Assigned Basic/Enhanced credit carryforward to be used on

credit may be claimed as a certificated credit if a taxpayer

the next MBT return.

has a preapproval letter by December 31, 2011, but has not

Line 26: Add lines 9, 15, and 23. This amount is the Special

fully claimed the credit by January 1, 2012.

The credit may

Consideration Credit carryforward to be used on the taxpayer’s

be claimed as either a refundable accelerated credit (on Form

next MBT return.

4889) or a non-refundable credit.

Non-refundable credits

Line 27: Add lines 25 and 20. This amount is the total Basic/

and non-refundable carryforwards of the credit are claimed

here. The credit must first be claimed in the year in which the

Enhanced credit carryforward to be used on the next MBT

certificate of completion is issued.

return.

A qualified taxpayer that has made the election to remain

MEGA Federal Contract Credit

taxable under the MBT with a certificated credit and has

The MEGA Federal Contract Credit is available for a qualified

received a pre-approval letter prior to January 1, 2008, under

the SBT Act to receive a Certificate of Completion may claim

taxpayer or collective group of taxpayers that have been

the credit (which is not a certificated credit) on this form,

awarded a federal procurement contract from the United States

Department of Defense, Department of Energy, or Department

provided that all other requirements are met.

of Homeland Security, resulting in a minimum of 25 new full-

time jobs. The credit amount is 100 percent of the qualified

For projects approved or amended by MEGA, prior to April

8, 2008, the credit is limited to 10 percent of the cost of the

taxpayer’s payroll attributable to employees who perform

eligible investment. For projects approved or amended on or

qualified new jobs as a result of the contract multiplied by the

after April 8, 2008, the credit is authorized for a percentage of

Michigan Individual Income Tax rate. Beginning January 1,

the cost of eligible investment to be determined by MEGA, up

2012, this credit is available as a certificated credit to the extent

to 20 percent of the cost.

that the taxpayer has entered into an agreement with MEGA by

A taxpayer claiming a nonrefundable certificated brownfield

December 31, 2011, but the credit has not been fully claimed

or paid prior to January 1, 2012. This credit must be claimed

credit may make the election in the year in which a credit is

beginning with the taxpayer’s first tax year ending after

available and will remain taxable under the MBT until the

December 31, 2011, in order for the taxpayer to remain taxable

qualifying credit and any carryforward of the credit are

extinguished. A taxpayer with a multiphase brownfield credit

under the MBT and claim the credit.

under MCL 208.1437(10), that makes the election, is required

This credit may be taken for a period of up to seven years, as

to continue to file and pay the MBT until the certificated

determined by MEGA. Any amount that exceeds the taxpayer’s

credit is complete and the credit is used up.

Except for a

tax liability may be refunded or carried forward for ten years

multiphase project, the Brownfield Redevelopment Credit

or until it is used up, whichever occurs first. To be eligible for

must first be claimed in the tax year in which the Certificate

the credit, a taxpayer must enter into an agreement with MEGA

and be certified by MEGA. If a misrepresentation is made on

of Completion is issued. For credits for a project approved by

MEGA with total credits greater than $10,000,000, the credits

the application for this credit, the designation of a qualified

must be claimed at the rate of 10 percent per year for ten

taxpayer may be revoked and the taxpayer may be required

years, beginning with the first year specified by MEGA on the

to refund or recapture credits received. Credit recapture is

Certificate of Completion.

calculated on Form 4587.

If a Brownfield Redevelopment Credit exceeds a taxpayer’s

For more information, contact MEDC at (517) 373-9808 or visit

tax liability for the year, the excess may be carried forward to

the MEDC Web site at

offset tax liability in subsequent tax years for a maximum of

Line 30: UBGs: Enter the unused credit amount from Form

ten years.

4580, Part 2B, line 51, column C.

NOTE: An unused SBT credit carryforward may be claimed

Line 33: Approved businesses receive a certificate from

against the tax imposed under the MBT for the same years

MEGA each year showing the total amount of tax credit

the carryforward would have been available under SBT, if the

allowed. Attach the Defense Contracting Tax Credit Certificate

taxpayer has made the election to remain taxable under the

to the return. (If the certificate is not attached, the credit will

MBT with a certificated credit, but it expires after ten years

be disallowed.)

(combined SBT and MBT years). This carryforward is claimed

on Form 4569.

Line 36: Add lines 32 and 35b. This is the MEGA Federal

Contract Credit carryforward to be used on the taxpayer’s next

All or a portion of the credit may be assigned. The assignment

MBT return.

of the credit is irrevocable, and except for an assignment based

on a multiphase project, must be made in the tax year in which

Brownfield Redevelopment Credit

the Certificate of Completion was issued. If proper assignment

The Brownfield Redevelopment Credit encourages businesses

is completed, the assignee may make the election to remain

taxable under the MBT on the basis of the assigned brownfield

to make an investment in eligible Michigan property that was

certificated credit in the year of assignment, provided that

used or is currently used for commercial, industrial, public, or

credit amount is available in that year.

residential purposes and is either a facility (environmentally

contaminated property), functionally obsolete, or blighted.

The administration of the Brownfield Redevelopment Credit

139

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9