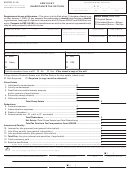

Form 92a200 - Kentucky Inheritance Tax Return Page 10

ADVERTISEMENT

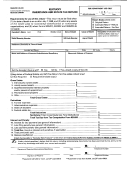

INSTRUCTIONS

PREVIOUSLY TAXED PROPERTY

(PRIOR DECEDENT TO IMMEDIATE DECEDENT wITHIN FIVE YEARS)

List all property owned by the immediate decedent at death that was taxed under

the Kentucky Inheritance and Estate Tax Law (KRS Chapter 140) and received from

a prior estate, the prior decedent having died within five years of the immediate

decedent’s date of death. Property listed in this schedule must be specifically identi-

fied as having been so taxed or as having been acquired in exchange for property

so taxed. All property correctly listed in this schedule is subject to a tax credit as

provided in KRS 140.095. Separate tax credit computations must be made if the

decedent paid tax in two or more prior estates.

Identify the property previously taxed and take full credit for the tax paid by the

immediate decedent in the prior estate. If full credit is not allowable, you will be

billed for the additional tax plus applicable interest, if due. The credit is taken on

the Tax Computation schedule as a part of this return.

The methods used in evaluating property listed in this schedule will be the same

as those used in evaluating like property listed in other schedules. Property listed

in this schedule must be valued as of the date of the immediate decedent’s death

and must not appear in any other schedule.

See page 3 of general information for an example.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17