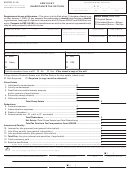

Form 92a200 - Kentucky Inheritance Tax Return Page 16

ADVERTISEMENT

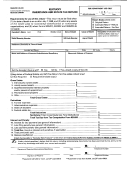

INSTRUCTIONS

DEBTS OF DECEDENT

Debts and taxes of the decedent paid by the personal representative are

deductible. Real property taxes that were a lien against the decedent’s property

at the date of death are deductible. Indicate the decedent’s percentage of

liability for debts and taxes on jointly owned property. If the decedent is

survived by a husband, her debts, with the exception of taxes or mortgages

on her real property, are not deductible unless paid from the proceeds of her

estate.

List in this schedule all mortgages and liens of the decedent. Indicate the de-

cedent’s share of liability if mortgage is secured by jointly owned property.

Mortgages are not deductible to the extent secured by credit life insurance.

FEDERAL ESTATE TAX

The figure for this calculation should be obtained from the Federal Estate and

Gift Tax Return.

The federal estate tax is deductible in the proportion that the net estate in

Kentucky subject to the federal estate taxes bears to the total net estate

everywhere subject to federal estate taxes. This is calculated by dividing the

Kentucky net estate, before the federal estate tax deduction, by the federal

taxable estate including federal taxable gifts.

PROPERTY HAVING A SITUS OUTSIDE KENTUCKY

Show location, description and actual value, at date of death, of all decedent’s

property having a situs outside Kentucky. This information is necessary to

determine the amount of federal estate tax allowable as a deduction under

KRS 140.090(1)(d). List mortgages and taxes on property. Intangible property

located outside Kentucky is taxable and must be reported on the return if the

decedent was domiciled in Kentucky.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17