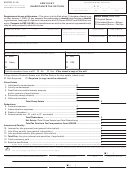

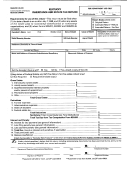

Form 92a200 - Kentucky Inheritance Tax Return Page 8

ADVERTISEMENT

INSTRUCTIONS

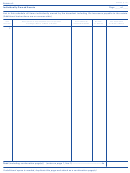

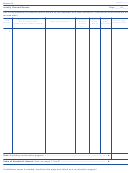

QUALIFIED TERMINABLE INTEREST PROPERTY

AND/OR

POwERS OF APPOINTMENT

KRS 140.100(4) requires that the value of a surviving spouse’s interest in a power of appointment trust or

in qualified terminable interest property which was exempt as a part of the surviving spouse’s inheritable

interest in the first spouse’s estate pursuant to an election made under KRS 140.080(1)(a) is includable in

the surviving spouse’s estate. The property is includable at its value on the surviving spouse’s date of death.

The personal representative of the decedent’s estate is entitled to recover from the trust or life estate the

tax attributable to the trust unless the decedent directs otherwise in his will.

Powers of Appointment

All property passing under a power of appointment created by will, deed, trust agreement, contract, insur-

ance policy or other instrument must be reported in this schedule whether or not the power of appointment

is exercised. For taxation of transfers by power of appointment, refer to KRS 140.040 and 140.100(4).

The method of computing the inheritance tax on any power of appointment property as described under

KRS 140.040 is irrelevant in both the donor’s and the donee’s estates when such property is elected to

be included in the surviving spouse’s total inheritable interest as property which qualifies for the federal

estate tax marital deduction under Section 2056(b)(5) or 2056(b)(7) of the Internal Revenue Code.

KRS 140.100(4) requires that the trust or life estate for which an election relates be included in the surviv-

ing spouse’s estate for Kentucky inheritance tax purposes at its value on the death of the surviving spouse

regardless of where spouse is domiciled. If the surviving spouse has the power to appoint the remainder-

men of the qualified trust or life estate, the property is taxed to the remaindermen named in the surviv-

ing spouse’s will and the rates and exemptions are based on their relationship to the surviving spouse. If

the surviving spouse has no power to appoint the remaindermen of the qualified trust or life estate, the

property is taxed to the remaindermen named in the first spouse’s will and the rates and exemptions are

based on their relationship to the second spouse unless such rates and exemptions prove to increase the

tax liability. If this occurs, the beneficiary may use the rates and exemptions in effect at the death of the

first spouse. If the first decedent was a nonresident of Kentucky or died prior to July 1, 1985, the trust or

life estate is not includable in the surviving spouse’s estate.

Qualified Terminable Interest Property

For purpose of the spousal exemption, the term total inheritable interest may include at the election of the

personal representative (or trustee or transferee, if no personal representative) the entire value of a trust

or property in which the surviving spouse was devised a life estate and which otherwise qualifies for the

federal estate tax marital deduction under Section 2056(b)(5) or 2056(b)(7) of the Internal Revenue Code

of 1954, as amended through December 31, 1984. The election is irrevocable and must be made on Form

92A936 on or before the due date of the tax return (as extended) or with the first tax return filed, whichever

occurs last. It is not necessary that a similar election be made for purposes of the federal estate tax marital

deduction or that a Federal Estate and Gift Tax Return be filed. The effect of the election is that the property

(interest) will be treated as passing to the surviving spouse for purposes of the spousal exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17