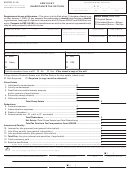

Form 92a200 - Kentucky Inheritance Tax Return Page 6

ADVERTISEMENT

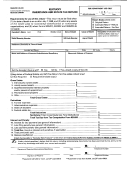

INSTRUCTIONS

JOINTLY OwNED ASSETS

All jointly owned property whether real estate (for reporting agricultural or hor-

ticultural land, see General Information—Valuation of Property—Fair Cash and

Agricultural), tangible personal property, bank accounts, stocks, bonds, etc., must

be reported (see KRS 140.050 below). All property placed in joint ownership by the

decedent within three years of the date of death is subject to the tax in its entirety

(see KRS 140.020(2) below). However, there is no presumption of contemplation

of death as to certificates of deposit jointly owned, and only the percent of owner-

ship of the decedent is taxable (see KRS 140.020(3) below).

KRS 140.020(2) reads as follows: Every transfer made within three (3) years

prior to the death of the grantor, vendor or donor of a material part of his

estate, or in the nature of a final disposition or distribution thereof, and

without an adequate valuable consideration, shall be construed prima

facie to have been made in contemplation of death within the meaning

of this chapter. If a transfer was made more than three (3) years prior to

the death of the decedent it shall be a question of fact, to be determined

by the proper tribunal, whether the transfer was made in contemplation

of death.

KRS 140.020(3) reads as follows: There shall be no presumption of con-

templation of death as to certificates of deposit jointly owned and all such

certificates of deposit shall be taxed pursuant to KRS 140.050.

KRS 140.050 reads as follows: Whenever any real or personal property

is held jointly in the names of two (2) or more persons, or as tenants by

the entirety, or is deposited in banks or other depositories jointly in the

names of two (2) or more persons and is payable to either or to the sur-

vivor upon the death of the other, the right of the surviving tenant by the

entirety or the surviving joint tenant or joint depositor to the immediate

ownership or possession and enjoyment of the property shall be deemed

a transfer of one-half (1/2) or other proper fraction thereof, taxable under

the provisions of this chapter in the same manner as though the part of

the property to which the transfer relates belonged to the tenants by the

entirety, joint tenants or joint depositors as tenants in common, and had

been bequeathed or devised to the surviving tenant by the entirety, joint

tenant or joint depositor by the deceased tenant by the entirety, joint

tenant or just depositor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17