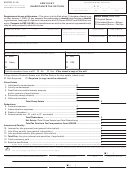

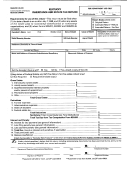

Form 92a200 - Kentucky Inheritance Tax Return Page 12

ADVERTISEMENT

INSTRUCTIONS

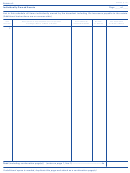

GIFTS AND TRANSFERS

Include all gifts and transfers of property in this schedule made by the decedent

within three years prior to death and any gift or transfer of property during

the decedent’s lifetime in which a life estate or the income was retained by

the decedent. If made by deed or trust, a copy of such instrument must be

attached. In the event the taxability of the gift or transfer is not included in the

taxable estate, submit details of the transfer and the reason for the exclusion.

To determine the proper taxation of gifts and transfers, refer to KRS 140.020

(see below). For reporting agricultural or horticultural land, see General

Information—Valuation of Property—Fair Cash and Agricultural.

KRS 140.020 reads in part as follows: (1) Any property or interest

therein, of which the decedent has made a transfer by trust or oth-

erwise, in contemplation of or intended to take effect in possession

or enjoyment at or after death, including a transfer under which the

transferor has retained for his life or any period not ending before

his death (a) the possession or enjoyment of, or the income from

the property; or (b) the actual or contingent power to designate the

persons who shall possess the property or the income therefrom,

except in the case of a bona fide sale for an adequate and full con-

sideration in money or money’s worth. It shall further apply to any

property conveyed in trust over which the settlor has a power of

revocation exercisable by will.

(2) Every transfer made within three (3) years prior to the death of

the grantor, vendor or donor of a material part of his estate, or in the

nature of a final disposition or distribution thereof, and without an ad-

equate valuable consideration, shall be construed to have been made

in contemplation of death within the meaning of this chapter.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17