Form 92a200 - Kentucky Inheritance Tax Return Page 17

ADVERTISEMENT

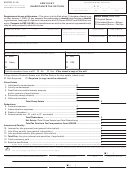

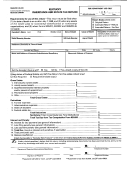

Estate of: ___________________________________________________

92A200 (3-12)

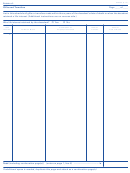

TAX COMPUTATION

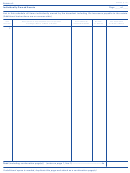

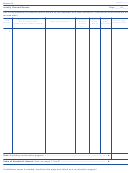

List Names of Heirs and Beneficiaries Including

Relationship

Exempt Transfers. Itemize Shares of Property

Age

Distributive Share

Tax

(If Any)

Received. (See general information.)

$

$

$

Total distributive shares (must equal Net Estate, page 1) .......................................

$

Inheritance tax .........................................................................................................................................................

–

Discount of 5% from tax if paid within 9 months from death ..............................................................................

–

Less deferred payments (See general information) .............................................................................................

$

Total Tax Due (enter on page 1) .............................................................................................................................

IF A FEDERAL ESTATE AND GIFT TAX RETURN wAS REQUIRED TO BE FILED,

ATTACH A COPY TO THIS RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17