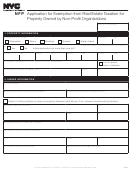

NFP

Exemption from Real Estate Taxation for Property Owned by Non-Profit Organizations

You may be eligible for a partial exemption if you own the property and use the property primarily for an

exempt purpose but:

– Rent a portion to a nonprofit that qualifies for an exemption in its own right as long as the rent it pays does not exceed

the maintenance, depreciation and carrying costs of the property.

– Rent a portion to a commercial (for-profit) or unaffiliated tenant. The space that is rented is subject to real estate taxes.

– Have vacant or unused space and no demonstrable plans to use the vacant/unused space. Vacant/unused space is

subject to real estate taxes.

BEFORE YOU SUBMIT YOUR APPLICATION, complete the items on the checklist below to ensure prompt

processing. Incomplete applications will not be reviewed.

Mail your completed application to:

New York City Department of Finance

Commercial Exemptions – NFP

59 Maiden Lane, 22nd Floor

New York, NY 10038

Check off these tasks as you complete them to make sure you have completed all requirements.

✓

Complete Section 1 Property Information

✓

Complete Section 2 Owner Information

✓

Complete Section 3 Organizational Purpose

✓

Complete Section 4 Federal Income Tax Status of Organization

✓

Complete Sections 5–7 Property Use

✓

Complete Affidavit (sign and notarize)

✓

Attach Articles of Incorporation

✓

Attach by-laws

✓

Attach deed (if parcel is in Staten Island or not recorded in ACRIS)

✓

Attach a Certificate of Occupancy

✓

If you are leasing any part of the parcel to a not-for-profit, attach that organization’s Articles and By-laws

✓

If leasing, attach the lease

✓

If applying for a parsonage, attach ordination document

✓

If applying for contemplated use, attach building plans/architect’s drawing or Department of Buildings

permit or evidence of building fund

✓

Review application and attachments for completeness before mailing to DOF

Prior to exemption determination, inspection may be required by Department of Finance.

–

–

If exemption is granted, the organization will be required to file an annual renewal form prescribed by the

Department of Finance.

How to Appeal Decisions

If the Department of Finance (DOF) denies your application or grants only a partial exemption, you may appeal the

decision with the New York City Tax Commission. Use Tax Commission form TC106, available at

html/taxcomm. Be sure to attach a copy of the DOF notice to your application. Please note: Appeals for partial

exemption must be received within twenty (20) calendar days of the mailing date of the DOF letter. Appeals for full

exemptions may be submitted at any time.

All submitted applications will be reviewed in accordance with the legal statutes cited below.

The information in this form is in accordance with Article 4, Sections 420-a, 420-b, 446, 452 and 462 of the New York State Real Property Tax Law, which

provides for real estate tax exemption for certain properties owned and used by nonprofit organizations that qualify under the provisions of these sections.

2

8 /2016

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8