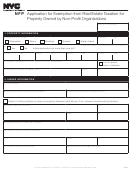

NFP

Exemption from Real Estate Taxation for Property Owned by Non-Profit Organizations

AFFIDAVIT

STATE OF

COUNTY

DATE

being duly sworn, says under penalty of perjury that s/he

________________________________________________________________,

is the applicant or the

of the applicant, that the statements

________________________________________________________________

contained in this application, including any attachments to this application, are true to his/her knowledge

.

SIGNATURE OF APPLICANT OR REPRESENTATIVE

AFFIX OFFICIAL STAMP OR SEAL OF THE NOTARY HERE

Subscribed and sworn to before me this

day of

. 20

_______________

_____________________________________________

___________

NOTARY PUBLIC OR COMMISSIONER OF DEEDS SIGNATURE

Did you...

Read the eligibility requirements and instructions to

Attach a copy of the lease, if leasing?

be sure that you are qualified?

If applying for contemplated use, attach building

plans/architect’s drawing or Department of

Complete all sections and individual questions on

Buildings permit or evidence of building fund?

the attached application?

Attach ordination document, if all or a portion of the

Submit separate Sections 5–7 Property Use for

property is used as a parsonage or manse? The

each individual lot for which you are applying for

statement should include the following information:

exemption?

names of all officiating clergy; documentation of

Attach a copy of your organization’s Articles of

ordination; if no formal training and/or ordination

Incorporation?

was received, please explain why; if clergy has an

Attach a copy of your organization’s By-Laws or

employment contract with the owning organization,

Constitution?

please submit most recent copy.

Attach a copy of your deed if not in ACRIS or

Sign the affidavit and have it notarized where

parcel is in Staten Island?

indicated?

Attach a copy of your Certificate of Occupancy?

Submit your application:

If all or a portion of the property is leased to and

used by another nonprofit organization, attach that

New York City Department of Finance

organization’s Articles of Incorporation, By-Laws

Commercial Exemptions – NFP

or Constitution, IRS Returns, IRS Form 990-T, IRS

59 Maiden Lane, 22nd Floor

exemption letter or IRS exemption application?

New York, NY 10038

8

8 /2016

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8