Shopping For Your Home Loan: Hud'S Settlement Cost Booklet - U.s. Department Of Housing And Urban Development (Hud) Page 12

ADVERTISEMENT

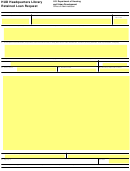

Summary of Your Loan

The Summary of Your Loan Terms discloses your loan amount, loan term, the

initial interest rate and the principal, interest and mortgage insurance portion of your

monthly mortgage payment. It also informs you if your interest rate can increase, if

your loan balance can rise, whether your mortgage payment can rise and if there is a

prepayment penalty or balloon payment.

In the example above, the loan amount is $200,000 which will be paid over 30

years. The initial interest rate is 5 percent and the initial monthly mortgage payment

is $1,173 which includes mortgage insurance, but does not include any amounts to

pay for property taxes and homeowner’s insurances if required by the lender.

In our example, the loan has an adjustable interest rate. Since the interest

rate can rise, the ‘yes’ box was checked, and the loan originator disclosed that the

initial interest rate of 5 percent could rise as high as 10 percent. The first time your

interest rate could rise is 6 months after settlement which could increase your

.

payments to $1,290

Over the life of your loan your monthly payments could increase

from $1,173 to $1,842.

This example does not contain a balloon payment or a prepayment penalty.

NOTE: A prepayment penalty is a charge that is assessed if you pay off the loan

within a specified time period, such as three years. A balloon payment is due on a

mortgage that usually offers a low monthly payment for an initial period of time.

After that period of time elapses, the balance must be paid by the borrower, or the

amount must be refinanced. You should think carefully before agreeing to these

kinds of mortgage loans. If you are unable to refinance or pay the balance of the

loan, you could put your home at risk.

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48