Shopping For Your Home Loan: Hud'S Settlement Cost Booklet - U.s. Department Of Housing And Urban Development (Hud) Page 40

ADVERTISEMENT

Home Inspection: an inspection of the mechanical, electrical, and structural

aspects of your home. You will pay a fee for this inspection, and the inspector will

provide you a written report evaluating the condition of the home.

Homeowner's Insurance or Home Hazard Insurance: an insurance policy that

protects your home and your possessions inside from serious loss, such as theft or

fire. This insurance is usually required by all lenders to protect their investment

and must be obtained before closing on your loan.

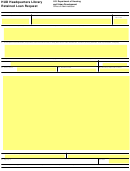

HUD-1 Settlement Statement: a statement that itemizes the services provided

to you and the fees charged for those services. This form is filled out by the person

who will conduct the settlement. You can ask to see your settlement statement at

least one day prior to your settlement.

Interest: a fee charged by the lender for the use of its money.

Interest rate: the charge by the lender for borrowing money expressed as a

percentage.

Lender Inspection Fees: this charge covers inspections, often of newly

constructed housing, made by employees of your lender or by an outside inspector.

Loan to value (LTV) ratio: a percentage calculated by dividing the amount to be

borrowed by the price or appraised value of the home to be purchased (whichever

is less). The loan to value ratio is used to qualify borrowers for a mortgage, and the

higher the LTV, the tighter the qualification guidelines for certain mortgage

programs become. Low loan to value ratios are considered below 80%, and carry

lower rates since borrowers are lower risk.

Mortgage: the transfer of an interest in property to a lender as a security for a

debt. This interest may be transferred with a Deed of Trust in some states.

Origination Fee: a fee charged to the borrower by the loan originator for making

a mortgage loan.

Origination Services: any service involved in the creation of a mortgage loan,

including but not limited to the taking of the loan application, loan processing, and

the underwriting and funding of loan, and the processing and administrative

services required to perform these functions.

Payment Shock: a scenario in which monthly mortgage payments on an

adjustable rate mortgage (ARM) rise so high that the borrower may not be able to

afford the payments.

PITI: Principal, Interest, Taxes and Insurance: the four elements of a

monthly mortgage payment; payments of principal and interest go directly towards

repaying the loan while the portion that covers taxes and insurance goes into an

escrow account to cover the fees when they are due.

40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48