Shopping For Your Home Loan: Hud'S Settlement Cost Booklet - U.s. Department Of Housing And Urban Development (Hud) Page 26

ADVERTISEMENT

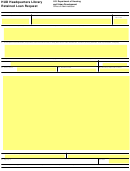

Line 1104 lists the charge for the Lender’s title insurance policy which is part of

the charge listed in Line 1101.

Line 1105 is the Lender’s title policy limit. It often is lower than the value of the

property because it only covers the amount of your lender’s lien on your property.

Line 1106 lists the Owner’s title policy limit. The liability limit of the owner's

policy is typically the purchase price paid for the property.

Line 1107 lists the portion of the title insurance premiums retained by the title

insurance agent.

Line 1108 lists the portion of the title insurance premiums retained by the

underwriter.

1200 Series, Government Recording and Transfer Charges

Government recording charges listed in the 1200 series on the HUD-1 are

charges paid to state and local governmental agencies to record important documents

such as the deed and mortgage or deed of trust and transfer taxes to legally transfer

property.

Line 1201 lists all government recording charges and corresponds to Block 7 of

your GFE. This represents the cumulative amount the borrower is paying for

government recording charges.

Line 1202 itemizes specific recording charges for the deed, the mortgage, and

any releases of prior liens against your property shown in Line 1201. When the seller

pays for an item, such as a release, the charge is listed in the seller’s column.

In this example, the borrower is paying $50.00 of the recording charges, and

the seller is paying $15.00. The total paid for the government recording charges was

$65.00 (borrower $50.00 / seller $15.00).

Line 1203 lists the charge for transfer taxes. Transfer taxes are charged by

state or local government to transfer real property or place a new lien (mortgage or

deed of trust) on a property. This charge is listed in Block 8 of your GFE.

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48