Self-Employment Tax Organizer Template Page 2

ADVERTISEMENT

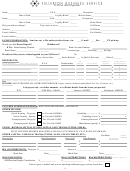

Self-Employment Tax Organizer – SETO

Business or profession:

_________________________________________________

Business name:

_________________________________________________

(If no separate business name, leave blank)

Business address, city, state, zip:

_________________________________________________

Business telephone:

_________________________________________________

Business start date (

):

st

1

day

_________________________________________________

INCOME

Forms 1099 including 1099-MISC and 1099-K

$

Total cash, checks, and credit card payments (to you)

$

Sales tax collected

$

Other income – prizes, incentives or awards

$

Total Gross Income

$

TIP:

Keep separate business accounts (checking or credit) to simplify your finances and your deposits

into these accounts should match, or come close to, your total gross income.

HEALTH INSURANCE PREMIUMS

Did you pay health insurance premiums in 2015?

Yes

No

$

If yes, how much?

TIP:

These premiums, in the name of the business or self-employed taxpayer, may be 100%

deductible. If you received health insurance through the Marketplace (MNSure), bring in Form 1095-A.

ESTIMATED TAX PAYMENTS

Did you pay estimated tax payments to the IRS or Minnesota

Yes

No

Department of Revenue in 2015?

IRS

$

If yes, how much?

MDOR

$

Prepare + Prosper, 2610 University Avenue W, Suite LL, St. Paul MN 55114,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4