Self-Employment Tax Organizer Template Page 4

ADVERTISEMENT

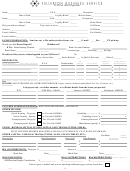

Self-Employment Tax Organizer – SETO

EXPENSES: MAJOR PURCHASES

Item

Month/day/year of purchase

Cost

/

/

$

/

/

$

TIP:

If you had major purchases last year and P + P didn’t prepare your return, it is especially important

to bring in that return.

PRODUCTS SOLD BY DIRECT SELLER – COST OF GOODS SOLD

1. Inventory at the beginning of the year

$

2. Product purchased during the year (less cost of products taken

for personal use)

$

List amount here of product taken for personal use $

3. Materials and supplies added to product for resale

$

4. Other costs (miscellaneous)

$

5. Add lines 1 through 4

$

6. Inventory at the end of the year

$

(For volunteer use) Cost of goods sold - subtract line 6 from line 5

$

VEHICLE INFORMATION

Month/day/year vehicle first used for business:

/

/

Mileage in 2015:

business miles __________

commuting miles____________ personal mile____________

Parking and tolls: $

Interest paid on car loan: $

Was your vehicle available for personal use during off-duty hours?

Yes

No

Do you (or your spouse) have another vehicle available for personal use?

Yes

No

Do you have evidence to support your deduction?

Yes

No

If yes, is the evidence in writing?

Yes

No

TIP:

Your first trip from home to a work site and last trip from a work site to your home, are considered

commuting miles (unless you have an office in the home) and are not deductible business miles.

Business miles are from one work site to another work site and are deductible.

Prepare + Prosper, 2610 University Avenue W, Suite LL, St. Paul MN 55114,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4