Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

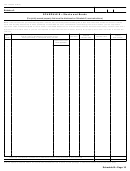

SCHEDULE E—Jointly Owned Property

(If you elect section 2032A valuation, you must complete Schedule E and Schedule A-1.)

PART 1. Qualified Joint Interests—Interests Held by the Decedent and His or Her Spouse as the Only Joint

Tenants (Section 2040(b)(2))

Note. If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and the

Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to

report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions and Reg. section 20.2010-2T

(a)(7)(ii) for more information. If you are not required to report the value of an asset, identify the property but make no entries in the last three

columns.

Item

Description. For securities, give CUSIP number. If trust, partnership, or closely held entity,

Alternate valuation

Value at

Alternate value

number

give EIN.

date

date of death

CUSIP number or

EIN, where

applicable

1

Total from continuation schedules (or additional statements) attached to this schedule .

.

.

.

.

1a

1a

Totals .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1b

Amounts included in gross estate (one-half of line 1a) .

.

.

.

.

.

.

.

.

.

.

.

.

1b

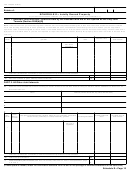

PART 2. All Other Joint Interests

2a

State the name and address of each surviving co-tenant. If there are more than three surviving co-tenants, list the additional co-tenants on an

attached statement.

Name

Address (number and street, city, state, and ZIP code)

A.

B.

C.

Enter

Item

Description (including alternate valuation date if any). For securities, give CUSIP

Includible alternate

Includible value at

Percentage includible

letter for

number

number. If trust, partnership, or closely held entity, give EIN

value

date of death

co-tenant

CUSIP number or

EIN, where

applicable

1

Total from continuation schedules (or additional statements) attached to this schedule .

.

.

.

.

2b

Total other joint interests

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b

3

Total includible joint interests (add lines 1b and 2b). Also enter on Part 5—Recapitulation, page

3

3, at item 5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedule E—Page 13

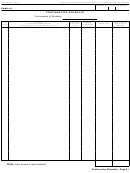

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31