Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

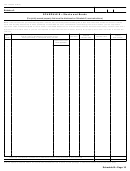

SCHEDULE G—Transfers During Decedent’s Life

(If you elect section 2032A valuation, you must complete Schedule G and Schedule A-1.)

Note. If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and the

Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to

report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions and Reg. section 20.2010-2T

(a)(7)(ii) for more information. If you are not required to report the value of an asset, identify the property but make no entries in the last three

columns.

Item

Description. For securities, give CUSIP number. If trust,

Alternate

Value at

Alternate value

number

partnership, or closely held entity, give EIN

valuation date

date of death

A.

Gift tax paid or payable by the decedent or the estate for all gifts

made by the decedent or his or her spouse within 3 years before the

decedent’s death (section 2035(b)) .

.

.

.

.

.

.

.

.

.

.

.

X X X X X

B.

Transfers includible under sections 2035(a), 2036, 2037, or 2038:

1

Total from continuation schedules (or additional statements) attached to this schedule .

.

TOTAL. (Also enter on Part 5—Recapitulation, page 3, at item 7.) .

.

.

.

.

.

.

.

.

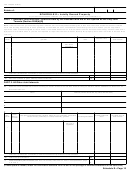

SCHEDULE H—Powers of Appointment

(Include “5 and 5 lapsing” powers (section 2041(b)(2)) held by the decedent.)

(If you elect section 2032A valuation, you must complete Schedule H and Schedule A-1.)

Note. If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and the

Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to

report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions and Reg. section 20.2010-2T

(a)(7)(ii) for more information. If you are not required to report the value of an asset, identify the property but make no entries in the last three

columns.

Item

Alternate valuation

Value at

Description

Alternate value

number

date

date of death

1

Total from continuation schedules (or additional statements) attached to this schedule

.

.

.

TOTAL. (Also enter on Part 5—Recapitulation, page 3, at item 8.)

.

.

.

.

.

.

.

.

.

.

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedules G and H—Page 15

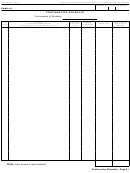

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31