Form 706 (Rev. 8-2013)

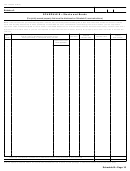

SCHEDULE R—Generation-Skipping Transfer Tax

Note. To avoid application of the deemed allocation rules, Form 706 and Schedule R should be filed to allocate the GST exemption to

trusts that may later have taxable terminations or distributions under section 2612 even if the form is not required to be filed to report

estate or GST tax.

The GST tax is imposed on taxable transfers of interests in property located outside the United States as well as property located

inside the United States. (see instructions)

Part 1. GST Exemption Reconciliation (Section 2631) and Special QTIP Election (Section 2652(a)(3))

You no longer need to check a box to make a section 2652(a)(3) (special QTIP) election. If you list

qualifying property in Part 1, line 9 below, you will be considered to have made this election. See

instructions for details.

1

1

Maximum allowable GST exemption .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Total GST exemption allocated by the decedent against decedent’s lifetime transfers .

.

.

.

.

2

3

Total GST exemption allocated by the executor, using Form 709, against decedent’s lifetime

3

transfers .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

GST exemption allocated on line 6 of Schedule R, Part 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

GST exemption allocated on line 6 of Schedule R, Part 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

6

Total GST exemption allocated on line 4 of Schedule(s) R-1

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Total GST exemption allocated to inter vivos transfers and direct skips (add lines 2–6)

.

.

.

.

7

8

GST exemption available to allocate to trusts and section 2032A interests (subtract line 7 from

line 1) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Allocation of GST exemption to trusts (as defined for GST tax purposes):

A

B

C

D

E

GST exemption

Additional GST

Trust’s inclusion

Name of trust

Trust’s

allocated on lines 2–6,

exemption allocated

ratio (optional—see

EIN (if any)

above (see instructions)

(see instructions)

instructions)

9D Total. May not exceed line 8, above .

.

.

.

.

.

.

.

.

.

.

9D

10

GST exemption available to allocate to section 2032A interests received by individual beneficiaries

10

(subtract line 9D from line 8). You must attach special-use allocation statement (see instructions) .

Schedule R—Page 23

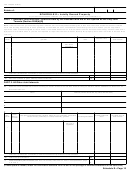

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31