Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

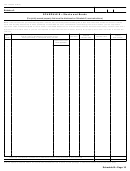

SCHEDULE A-1—Section 2032A Valuation

Part 1. Type of election (Before making an election, see the checklist in the instructions):

Protective election (Regulations section 20.2032A-8(b)). Complete Part 2, line 1, and column A of lines 3 and 4. (see instructions)

Regular election. Complete all of Part 2 (including line 11, if applicable) and Part 3. (see instructions)

Before completing Schedule A-1, see the instructions for the information and documents that must be included to make a valid

election.

The election is not valid unless the agreement (that is, Part 3. Agreement to Special Valuation Under Section 2032A):

• Is signed by each qualified heir with an interest in the specially valued property and

• Is attached to this return when it is filed.

Part 2. Notice of election (Regulations section 20.2032A-8(a)(3))

Note. All real property entered on lines 2 and 3 must also be entered on Schedules A, E, F, G, or H, as applicable.

1

Qualified use—check one

Farm used for farming, or

▶

Trade or business other than farming

2

Real property used in a qualified use, passing to qualified heirs, and to be specially valued on this Form 706.

B

D

A

C

Full value

Value based on qualified use

Schedule and item number

Adjusted value (with section 2032A

(without section 2032A(b)(3)(B)

(without section 2032A(b)(3)(B)

from Form 706

(b)(3)(B) adjustment)

adjustment)

adjustment)

Totals .

.

.

.

.

.

.

.

.

.

Attach a legal description of all property listed on line 2.

Attach copies of appraisals showing the column B values for all property listed on line 2.

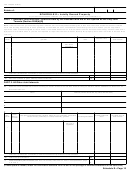

3

Real property used in a qualified use, passing to qualified heirs, but not specially valued on this Form 706.

B

D

A

C

Full value

Value based on qualified use

Schedule and item number

Adjusted value (with section 2032A

(without section 2032A(b)(3)(B)

(without section 2032A(b)(3)(B)

from Form 706

(b)(3)(B) adjustment)

adjustment)

adjustment)

Totals .

.

.

.

.

.

.

.

.

.

If you checked “Regular election,” you must attach copies of appraisals showing the column B values for all property listed on line 3.

(continued on next page)

Schedule A-1—Page 6

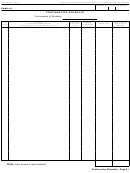

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31