Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

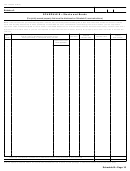

SCHEDULE P—Credit for Foreign Death Taxes

List all foreign countries to which death taxes have been paid and for which a credit is claimed on this return.

If a credit is claimed for death taxes paid to more than one foreign country, compute the credit for taxes paid to one country on

this sheet and attach a separate copy of Schedule P for each of the other countries.

The credit computed on this sheet is for the

(Name of death tax or taxes)

imposed in

(Name of country)

Credit is computed under the

(Insert title of treaty or statute)

Citizenship (nationality) of decedent at time of death

(All amounts and values must be entered in United States money.)

1 Total of estate, inheritance, legacy, and succession taxes imposed in the country named above attributable to

1

property situated in that country, subjected to these taxes, and included in the gross estate (as defined by statute) .

2 Value of the gross estate (adjusted, if necessary, according to the instructions)

.

.

.

.

.

.

.

.

.

.

.

2

3 Value of property situated in that country, subjected to death taxes imposed in that country, and included in the

3

gross estate (adjusted, if necessary, according to the instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4 Tax imposed by section 2001 reduced by the total credits claimed under sections 2010 and 2012 (see instructions)

4

5 Amount of federal estate tax attributable to property specified at item 3. (Divide item 3 by item 2 and multiply the

result by item 4.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Credit for death taxes imposed in the country named above (the smaller of item 1 or item 5). Also enter on line 13 of

6

Part 2—Tax Computation .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

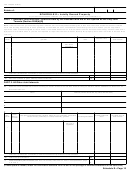

SCHEDULE Q—Credit for Tax on Prior Transfers

Part 1. Transferor Information

IRS office where estate

Name of transferor

Social security number

Date of death

tax return was filed

A

B

C

Check here

if section 2013(f) (special valuation of farm, etc., real property) adjustments to the computation of the credit were made (see instructions).

▶

Part 2. Computation of Credit (see instructions)

Total

Transferor

Item

A, B, & C

A

B

C

1 Transferee’s tax as apportioned (from worksheet,

(line 7 ÷ line 8) × line 35 for each column)

.

.

.

2 Transferor’s tax (from each column of worksheet,

line 20)

.

.

.

.

.

.

.

.

.

.

.

.

.

3 Maximum amount before percentage requirement

(for each column, enter amount from line 1 or 2,

whichever is smaller)

.

.

.

.

.

.

.

.

.

4 Percentage allowed (each column) (see instructions)

%

%

%

5 Credit allowable (line 3 × line 4 for each column)

.

6 TOTAL credit allowable (add columns A, B, and C of

line 5). Enter here and on line 14 of Part 2—Tax

Computation .

.

.

.

.

.

.

.

.

.

.

.

Schedules P and Q—Page 22

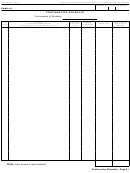

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31