Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

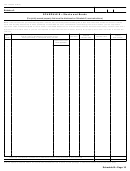

Part 3—Elections by the Executor

Note. For information on electing portability of the decedent's DSUE amount, including how to opt out of the election, see Part 6—

Portability of Deceased Spousal Unused Exclusion.

Yes No

Note. Some of the following elections may require the posting of bonds or liens.

Please check "Yes" or "No" box for each question (see instructions).

1

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Do you elect alternate valuation?

2

2

Do you elect special-use valuation? If “Yes,” you must complete and attach Schedule A-1

.

.

.

.

.

.

.

.

.

.

3

Do you elect to pay the taxes in installments as described in section 6166? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes,” you must attach the additional information described in the instructions.

Note. By electing section 6166 installment payments, you may be required to provide security for estate tax deferred

3

under section 6166 and interest in the form of a surety bond or a section 6324A lien.

4

4

Do you elect to postpone the part of the taxes due to a reversionary or remainder interest as described in section 6163?

.

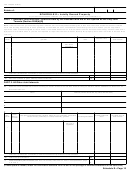

Part 4—General Information

Note. Please attach the necessary supplemental documents. You must attach the death certificate. (See instructions)

Authorization to receive confidential tax information under Reg. section 601.504(b)(2)(i); to act as the estate’s representative before the IRS; and to make written

or oral presentations on behalf of the estate:

Name of representative (print or type)

State

Address (number, street, and room or suite no., city, state, and ZIP code)

certified public accountant/

I declare that I am the

attorney/

enrolled agent (check the applicable box) for the executor. I am not under suspension or

disbarment from practice before the Internal Revenue Service and am qualified to practice in the state shown above.

Signature

CAF number

Date

Telephone number

1

Death certificate number and issuing authority (attach a copy of the death certificate to this return).

2

Decedent’s business or occupation. If retired, check here

and state decedent’s former business or occupation.

▶

3a

Marital status of the decedent at time of death:

Married

Widow/widower

Single

Legally separated

Divorced

3b

For all prior marriages, list the name and SSN of the former spouse, the date the marriage ended, and whether the marriage ended by

annulment, divorce, or death. Attach additional statements of the same size if necessary.

4a

4b Social security number

4c Amount received (see instructions)

Surviving spouse’s name

5

Individuals (other than the surviving spouse), trusts, or other estates who receive benefits from the estate (do not include charitable beneficiaries

shown in Schedule O) (see instructions).

Name of individual, trust, or estate receiving $5,000 or more

Identifying number

Relationship to decedent

Amount (see instructions)

All unascertainable beneficiaries and those who receive less than $5,000 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Total .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

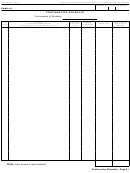

Yes No

If you answer “Yes” to any of the following questions, you must attach additional information as described.

6

Is the estate filing a protective claim for refund? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes,” complete and attach two copies of Schedule PC for each claim.

7

Does the gross estate contain any section 2044 property (qualified terminable interest property (QTIP) from a prior gift or estate)?

(see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8 a

Have federal gift tax returns ever been filed? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes,” attach copies of the returns, if available, and furnish the following information:

Period(s) covered

c Internal Revenue office(s) where filed

b

9a

Was there any insurance on the decedent’s life that is not included on the return as part of the gross estate? .

.

.

.

.

.

b

Did the decedent own any insurance on the life of another that is not included in the gross estate? .

.

.

.

.

.

.

.

.

Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31