Total Asset Management Template Page 10

ADVERTISEMENT

INTEGRATED CAPITAL INVESTMENT, ASSET MAINTENANCE AND ASSET

DISPOSAL STRATEGIES

6.

Capital Investment Strategy Developed

6.1. Outline the long term capital investment strategies for each asset type or risk category.

(Include operational, strategic and fiscal considerations affecting the way capital investment

projects will be organised and delivered.)

6.2. Outline the capital investment projects required to address the asset gap and effectively

deliver services, and the impacts of the project not proceeding. Identify whether each project

is aimed at delivering:

1. No change in levels of service (Maintenance of Service Effort), or

2. Enhanced levels of service (Enhancement of Service Effort).

Gaps in the performance of the asset portfolio requiring capital investment should have been

o

identified in the Asset Strategy.

The proposed capital investments should include all asset types (e.g. infrastructure/built assets,

o

plant, equipment, ICT, fleet). Smaller scale projects, similar in nature may be treated on a

program basis.

All projects must be prioritised within each group (i.e. Maintenance of Effort and Enhancement of

o

Effort)

Office accommodation – while details should be provided in Appendix 2, specific capital

o

proposals should be outlined here and prioritised against all other capital investment proposals.

For major capital investments (i.e. mainly infrastructure/built assets and ICT) the Capital

o

Investment Strategy should cover a ten year time frame.

The outline should include, for each project:

o

-

The objectives the project must meet to address the service delivery strategy and the asset

operating environment. ICT project objectives are set out in the IM&T Strategy and should be

summarised here to ensure alignment with the project objectives of other asset types.

-

estimated total cost,

-

classification (major or minor, new work or work in progress),

-

type (eg land acquisition, procurement of assets),

-

commencement and completion dates

-

projected cash flows.

-

The impacts on service delivery and current and future costs if the project does not proceed.

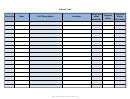

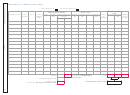

List all proposed new capital investment in Appendix 4 of this template.

o

Agencies should consult their Treasury analysts before undertaking extensive planning to avoid

o

wasted cost/effort.

6.3

Review the previous year’s Capital Investment Strategy and assess how much of it was

achieved.

Advise of changes made to the previous strategy and the reasons why some strategies and projects

o

did not eventuate. Advise of alternative unplanned projects that proceeded.

8

Total Asset Management Template (TAM06-6)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12