Form Nys-1-I - Instruction - Return Of Tax Withheld Page 2

ADVERTISEMENT

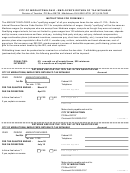

NYS-1-I (1/05) (back)

withheld, and $0 in City of Yonkers tax withheld, and have now

Item C

determined that $50 was actually withheld for New York City, enter $30

You may make additional payments with Form NYS-1. If you determine

(the amount underreported) on lines 2, 4, and 6. Do not make entries

that you have underreported and underpaid your tax liabilities, or only

on lines 1, 3, and 5.

partially paid the tax on a Form NYS-1 filed for the current quarter, an

To correct liabilities that were correctly reported but underpaid:

additional payment should be made to avoid further accruing of interest

and penalty charges. See the Additional payment section below.

– Complete item A and, if applicable, item B, with the payroll

information as it was reported on the originally filed Form NYS-1. Mark

Signature

an X in the item C box to indicate that you are making an additional

Your Form NYS-1 must be signed and dated by the officer or employee

payment. In this instance, there is no change in liability; therefore,

responsible for the filing of withholding tax returns and payment of

lines 1 through 5 should be left blank. Enter the amount of additional

withholding tax. Print or type that person’s name and telephone number

payment on line 6.

in the entry area near the signature.

Corrections to the amounts on lines 1 through 3 that do not alter line 4

should not be made as an additional payment, but should be reflected

Paid preparer and payroll service

on lines 12 through 14 of the Form NYS-45 filed for the quarter. You

If your return is being completed by a paid preparer, the paid preparer

may also use Form NYS-45, Part D, to correct withholding information

information, including signature, must be entered on the back of your

reported on Form(s) NYS-1 originally filed for that quarter and to report

return. A person who prepares your return and does not charge you

filing periods for which Form(s) NYS-1 were required but not filed.

should not sign the paid preparer’s area.

If you have to make any corrections to amounts withheld or additional

Note to paid preparers - When signing an employer’s Form NYS-1,

payments after you have filed Form NYS-45 for the quarter, you must

you must use the same identification number (social security number or

file Form NYS-45-X-MN, Amended Quarterly Combined Withholding,

federal preparer tax identification number) that you use when preparing

Wage Reporting, and Unemployment Insurance Return , and an

federal tax returns.

amended Form NYS-45-ATT-MN, if required (see Form NYS-45-X-I,

Instructions for Form NYS-45-X) .

If you are using a payroll service, the payroll service name and EIN

must be entered on the back of your return.

Avoid common errors

Indicate address change or new employer

Please try to avoid the following common errors:

Mark an X in the box on the front of Form NYS-1 if you are changing

1. Three or five business day due date - Employers notified to file

your withholding tax address. Enter, on the back of your return, the new

within three business days (including those who filed a Form TR-595,

address to which you want your withholding tax returns and notices

Request for Withholding Tax Filing Date Redetermination ) must

sent.

continue to file within three business days until notified by the Tax

Department of a redetermination.

New employers: If you are a new employer, enter the address to which

you want your withholding tax returns and notices sent on the back of

2. Last payroll date - Enter in box A the date the payroll was actually

the first Form NYS-1 you file, and mark an X in the address change or

paid to your employees, not the date of the last day of the payroll

new employer box located below the signature area on the front of

period.

Form NYS-1.

3. Permanently ceased paying wages date - Do not make an entry in

box B unless you have permanently ceased paying wages (that is,

Lines 1 through 4

gone out of business or no longer have employees to whom you pay

Enter the amount of taxes withheld on lines 1 through 3 and enter the

wages). Seasonal employers should not complete item B when they are

total on line 4. If you withheld taxes on wages for New York State,

temporarily ceasing wage payments due to the seasonal nature of their

New York City and/or Yonkers, you must enter the amounts withheld for

businesses.

the state and for each city separately on the appropriate lines. If you

4. Total tax withheld - Some employers have been erroneously

withheld tax from annuity, pension, retirement or individual retirement

entering their total tax withheld on line 3 (City of Yonkers tax withheld)

account payments, or from certain gambling winnings, the amount

instead of line 4 (Total withheld). The returns processing system adds

withheld must be included in the amounts entered on lines 1 through 4.

lines 1 through 3 to determine total liability and these employers appear

The amounts entered must equal the total amounts withheld from all

underpaid. Enter the amount of tax withheld for New York State,

payrolls being reported on your return. If you do not have New York City

New York City, and Yonkers on lines 1 through 3 and the total tax

or Yonkers withholding, leave the city line(s) blank.

withheld on line 4.

Line 5

Private delivery services

If you choose, you may use a private delivery service, instead of the

If you are claiming a credit, enter the amount of credit being used on

U.S. Postal Service, to file your return and pay tax. However, if, at a

your return on line 5. A credit can be used only if it is established by an

later date, you need to establish the date you filed your return or paid

overpayment (line 20) credited to the next quarter (line 20b marked) on

your tax, you cannot use the date recorded by a private delivery service

the quarterly return (Form NYS-45) filed for the preceding quarter, or if

unless you used a delivery service that has been designated by the

it is established by an overpayment on a Form NYS-1 filed for the

U.S. Secretary of the Treasury or the Commissioner of Taxation and

current calendar quarter.

Finance. (Currently designated delivery services are listed in

Line 6

Publication 55, Designated Private Delivery Services .) If you use any

private delivery service, address your return to: Bank One, NYS Tax

Subtract any credit claimed on line 5 from the total withheld on line 4,

Processing - NYS-1, 33 Lewis Road, Binghamton NY 13905-1040.

and enter the result on line 6. Make your check or money order payable

to NYS Income Tax for this amount. Write your identification number

Note: Use the address on the back of Form NYS-1 when mailing with

(as it appears on your Form NYS-1) on your check or money order.

the U.S. Postal Service.

Additional payment

Privacy notification

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant

Form NYS-1 may also be used to correct an underreported and/or

to the New York State Tax Law, including but not limited to, sections 171, 171-a, 287, 308, 429, 475,

underpaid condition before the filing of the quarterly return

505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers

pursuant to 42 USC 405(c)(2)(C)(i).

(Form NYS-45).

This information will be used to determine and administer tax liabilities and, when authorized by law,

To correct liabilities that were both underreported and underpaid:

for certain tax offset and exchange of tax information programs as well as for any other lawful

purpose.

– Complete item A, and if applicable, item B, with the payroll

Information concerning quarterly wages paid to employees is provided to certain state agencies for

purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain

information as it was reported on the originally filed Form NYS-1. Mark

employment and training programs and other purposes authorized by law.

an X in the item C box to indicate that you are making an additional

Failure to provide the required information may subject you to civil or criminal penalties, or both,

payment. Enter on lines 1 through 4 only the additional amounts you

under the Tax Law.

have determined to be due. For example, if you had originally reported

This information is maintained by the Director of Records Management and Data Entry, NYS Tax

Department, W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From areas

$100 in New York State tax withheld, $20 in City of New York tax

outside the United States and outside Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2