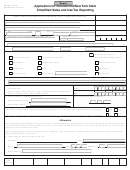

Form Dtf-82 - 2006 - Application For Qualified Empire Zone Enterprise (Qeze) Sales Tax Certification Page 2

ADVERTISEMENT

Page 2 of 4 DTF-82 (11/06)

Step 1

Enter the later of July 1, 2000, or the effective date (not the issue date) from your Certificate of Eligibility. This is your

test date. If you are certified in multiple empire zones, you must complete this application based on the effective date

/

/

of the first (earliest) Certificate of Eligibility issued. . ...................................................................................................................

Step 2

/

/

Enter the period on which your business’s tax year is based. ............................................................................

to

mm dd

mm dd

Tax year means the tax year of your business enterprise under Article 9‑A (Franchise Tax on

Business Corporations), Article 22 (Personal Income Tax), Article 32 (Franchise Tax on

Banking Corporations), or Article 33 (Franchise Tax on Insurance Corporations) of the Tax Law.

Step 3

(a) Enter the dates of the last tax year ending before the test date

/

/

/

/

to

determined in Step 1. This is your test year. . ............................................................................

/

/

to

/

/

(b) Enter the dates of the five tax years immediately preceding the test year listed in 3(a),

/

/

to

/

/

above. This is your base period. If you have fewer than five years preceding the test year,

/

/

to

/

/

your base period is the smaller set of years.

/

/

to

/

/

If you do not have a base period, or if you have no employment numbers in your base period,

/

/

to

/

/

please continue with Step 4. If you had employees during any part of your base period,

skip Step 4 and continue with Step 5.

Step 4

Business enterprises that have no base period or no employment numbers in the base period must meet

the new business test below to qualify for QEZE sales tax exemptions. If this applies to you, continue below.

If not, skip to Step 5.

(a) Is your business entity substantially similar in ownership and operation to a business entity taxable, or

previously taxable, under Tax Law, Article 9, section 183, 184, 185, or 186; Article 9‑A, 32, or 33; Article 23

(or that would have been subject to Article 23 as this article was in effect January 1, 1980); or a business

entity for which the income or losses were included for your taxes under Article 22? . .........................................

Yes

No

• If No, mark an X in the New Business box at the top of Step 5 and proceed to Step 6.

• If Yes, you must provide substantiation that your business enterprise was formed for a valid business purpose and not solely to gain

empire zone benefits. You must attach a notarized statement describing in detail how your business meets the valid business purpose

test, then mark an X in the New Business box at the top of Step 5 and proceed to Step 6. The term valid business purpose means one

or more business purposes, other than the avoidance or reduction of taxation, which alone or in the combination constitute the primary

motivation for some business activity or transaction, which activity or transaction changes in a meaningful way, apart from tax effects,

the economic position of the taxpayer. The economic position of the taxpayer includes an increase in the market share of the taxpayer

or the entry by the taxpayer into new business markets.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4