Authorization Approval Form - Oregon Enterprise Zone

ADVERTISEMENT

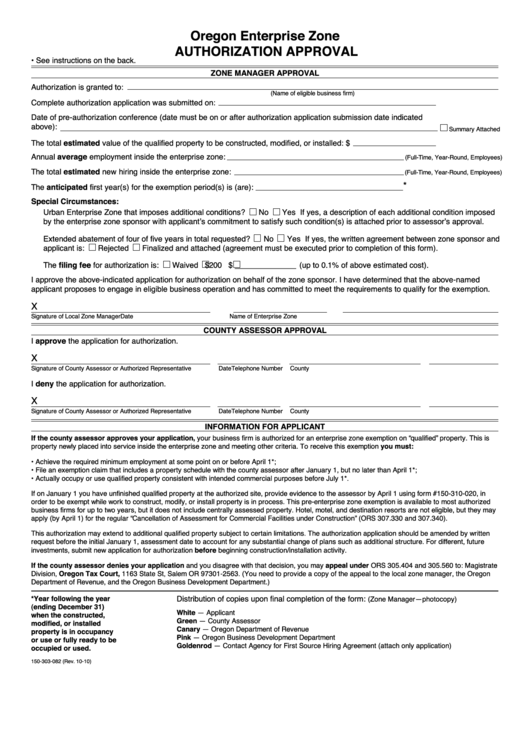

oregon enterprise Zone

authoriZation approval

• See instructions on the back.

Zone Manager approval

Authorization is granted to:

(Name of eligible business firm)

Complete authorization application was submitted on:

Date of pre-authorization conference (date must be on or after authorization application submission date indicated

above):

Summary Attached

The total estimated value of the qualified property to be constructed, modified, or installed: $

Annual average employment inside the enterprise zone:

(Full-Time, Year-Round, Employees)

The total estimated new hiring inside the enterprise zone:

(Full-Time, Year-Round, Employees)

*

The anticipated first year(s) for the exemption period(s) is (are):

special Circumstances:

Urban Enterprise Zone that imposes additional conditions? No Yes If yes, a description of each additional condition imposed

by the enterprise zone sponsor with applicant’s commitment to satisfy such condition(s) is attached prior to assessor’s approval.

Extended abatement of four of five years in total requested? No Yes If yes, the written agreement between zone sponsor and

applicant is: Rejected Finalized and attached (agreement must be executed prior to completion of this form).

The filing fee for authorization is: Waived $200 $ ______________ (up to 0.1% of above estimated cost).

I approve the above-indicated application for authorization on behalf of the zone sponsor. I have determined that the above-named

applicant proposes to engage in eligible business operation and has committed to meet the requirements to qualify for the exemption.

X

Signature of Local Zone Manager

Date

Name of Enterprise Zone

County assessor approval

I approve the application for authorization.

X

Signature of County Assessor or Authorized Representative

Date

County

Telephone Number

I deny the application for authorization.

X

Signature of County Assessor or Authorized Representative

Date

County

Telephone Number

inforMation for appliCant

if the county assessor approves your application, your business firm is authorized for an enterprise zone exemption on “qualified” property. This is

property newly placed into service inside the enterprise zone and meeting other criteria. To receive this exemption you must:

• Achieve the required minimum employment at some point on or before April 1*;

• File an exemption claim that includes a property schedule with the county assessor after January 1, but no later than April 1*;

• Actually occupy or use qualified property consistent with intended commercial purposes before July 1*.

If on January 1 you have unfinished qualified property at the authorized site, provide evidence to the assessor by April 1 using form #150-310-020, in

order to be exempt while work to construct, modify, or install property is in process. This pre-enterprise zone exemption is available to most authorized

business firms for up to two years, but it does not include centrally assessed property. Hotel, motel, and destination resorts are not eligible, but they may

apply (by April 1) for the regular “Cancellation of Assessment for Commercial Facilities under Construction” (ORS 307.330 and 307.340).

This authorization may extend to additional qualified property subject to certain limitations. The authorization application should be amended by written

request before the initial January 1, assessment date to account for any substantial change of plans such as additional structure. For different, future

investments, submit new application for authorization before beginning construction/installation activity.

if the county assessor denies your application and you disagree with that decision, you may appeal under ORS 305.404 and 305.560 to: Magistrate

Division, oregon tax Court, 1163 State St, Salem OR 97301-2563. (You need to provide a copy of the appeal to the local zone manager, the Oregon

Department of Revenue, and the Oregon Business Development Department.)

*year following the year

Distribution of copies upon final completion of the form:

(Zone Manager—photocopy)

(ending December 31)

White — Applicant

when the constructed,

green — County Assessor

modified, or installed

Canary — Oregon Department of Revenue

property is in occupancy

pink — Oregon Business Development Department

or use or fully ready to be

goldenrod — Contact Agency for First Source Hiring Agreement (attach only application)

occupied or used.

150-303-082 (Rev. 10-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2