Forms And Instructions For Application Form For Refund Of Montana Diesel Or Gasoline Tax Page 10

ADVERTISEMENT

7

Total miles traveled off-road in Montana: Enter the total number of miles traveled off public

roads and streets from your mileage logs.

8

Gallons used off-road in Montana: Divide line 7 by line 5.

9

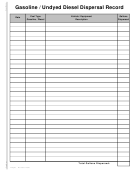

Total gallons dispersed from bulk storage into equipment: Enter the total from step 4, line g

above. Do Not enter vehicle fuel on this line.

10

Total gallons placed into equipment at the pump: Enter the totals of column C and column F

from the back of Schedule B. Do Not enter vehicle fuel on this line.

11

Total MT taxed gallons placed into equipment: Add lines 9 & 10.

12

Total gallons subject to off-road refund: Add lines 8 and 11 for gasoline and undyed diesel.

13

Tax paid per gallon: This is the current tax levied on gasoline and undyed diesel.

14

Amount of refund: Multiply line 12, gasoline gallons, by $0.27; multiply line 12, undyed diesel,

by $0.2775. This is your off-road refund amount.

½ STEP 6

: Take the refund amounts for gasoline and dyed diesel from line 14, and enter them on line

12, Column A and column B of form MF-Refund (Refund Application Form)

Schedule C – Power Take-Off Unit (PTO) Refund Instructions

This schedule needs to be attached to the Refund Application Form – MF-Refund

There are two parts to the PTO Fuel Usage Computations: 1) Undyed Diesel and 2) Gasoline.

½ STEP 1:

Begin by filling out the following columns in the Undyed Diesel part on the front of

Schedule C:

Column

Vehicle Identification Number (VIN): This number is required to verify that this is a PTO unit.

Vehicle Type # : On the back of Schedule C, find your vehicle type and enter the number that

corresponds to your vehicle in this column.

1 Miles operated in all jurisdictions: Enter the total miles operated for each PTO unit.

2 Total fuel used in vehicles: Enter the total gallons put into the supply tank of each PTO unit.

3 Average miles per gallon for all miles traveled: Divide column 1 by column 2.

4 Total Montana miles: Enter the total of over-the-road miles operated in Montana for each unit.

5 Montana off-road miles: Enter the total of off-road Montana miles operated for each PTO unit.

These are miles traveled off-road and on forest service development roads.

6 Montana on-road miles: Subtract column 4 from column 5.

7 Amount of Fuel used in Montana: Divide column 6 by column 3.

8 PTO Fuel Rate: Enter the PTO percentage rate from the back of the Schedule that corresponds

with your vehicle type number.

9 PTO fuel: Multiply column 7 by column 8. This is your PTO fuel tax refund for each unit.

½ STEP 2:

Add the amounts in column 9 to total the Undyed Diesel fuel used in Montana.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23