Forms And Instructions For Application Form For Refund Of Montana Diesel Or Gasoline Tax Page 9

ADVERTISEMENT

Schedule B – Off-Road Refund Instructions

This schedule needs to be attached to the Refund Application Form, (MF-Refund), along with your original

bulk invoices as proof of purchase.

½ STEP 1:

Begin b

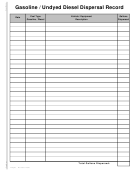

y filling out the BACK of Schedule B. List all purchases at the pump and bulk.

(Attach original bulk invoices). List your invoice purchases as indicated by each column

heading. Make sure gasoline and undyed diesel columns are totaled.

½ STEP 2:

Make sure all of your invoices meet the invoice requirements on page 2.

½ STEP 3:

Go to the FRONT of Schedule B

& fill out the name of the individual or business

who is applying for the refund.

½ STEP 4:

Fill out

lines (a) through (g) of the Summary of Bulk Storage Section

Line #

a

Beginning Inventory:

♦ If this is your first off-road refund, this amount will be your total gallons of fuel on hand

before you received any of the invoices you are sending in.

♦ If you have filed for off-road refunds before, your beginning inventory gallons will be the

ending inventory gallons from your last refund application.

b

Received into storage: Enter the totals from the back of Schedule A, column A,(gasoline) and

column D (undyed diesel).

c

Total Inventory: Add line a and line b.

d

Ending inventory: Enter the number of gallons you have left in your bulk storage.

e

Total fuel dispensed: Subtract line d from line c onto line e.

f

Portion of line (e) dispensed into vehicles: Enter the total gallons dispensed into your vehicles

from bulk storage shown on your dispersal records here and also on line 2 below.

g

Portion of line (e) dispensed into equipment: Enter the total gallons dispensed into your

equipment from bulk storage shown on your dispersal records here and also on line 9 below.

½ STEP 5:

Fill out lines 1 through 14 of the

Compute Refund Section. lines 1 through 8 pertain

only to motor vehicles; If you are only filing for off-road equipment go directly to line 9.

Line #

1

Total miles traveled in all jurisdictions: Enter the total number of miles traveled on all roads

from your mileage logs. International Fuel Tax Agreement (IFTA) vehicles do not qualify.

2

Total gallons dispensed from bulk storage into vehicles: Enter the amount from line f above.

Do Not put equipment fuel on this line.

3

Total fuel used in vehicles at the pump: Enter the amount on columns, B and/or E from the

back of Schedule B.

4

Total gallons used in vehicles: Add lines 2 and 3 for gasoline and undyed diesel.

5

Average miles per gallon: Divide line 1 by line 4.

6

Total miles traveled on public roads in Montana: Enter the total number of miles traveled on

public roads and streets in Montana from your mileage logs. Do Not include off-road miles.

July 2000

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23