Forms And Instructions For Application Form For Refund Of Montana Diesel Or Gasoline Tax Page 18

ADVERTISEMENT

Montana Department of Transportation

PO BOX 8019

HELENA MT 59604-8019

Phone:(406) 444-3832

FAX: (406) 444-6032 TTY: (406) 444-7696

Schedule B - Off-Road Refund

100% of the Montana tax on undyed diesel and gasoline used in a non-taxable manner

Applicant’s Name:

General Information

Qualification: A person who purchases and uses any undyed diesel or gasoline on which the Montana tax has been paid for

operating stationary engines and equipment used off the public roads, or for any commercial use other than operating vehicles upon

any of the public roads of this state.

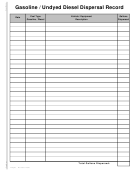

Required Records: Original bulk invoices are required to be sent in with application and listed on back of Schedule B.

Maintain a complete dispersal record containing dates, gallons and description of unit making withdrawals from bulk storage. Keep

dispersal and/or, mileage records and retail receipts in your files for a period of 3 years following date of this application.

When claiming a refund for fuel used in vehicles, mileage logs are required to be kept for each vehicle showing miles traveled on

and off the public roads and highways. Keep these mileage records in your files for a period of 3 years following date of this

application.

Summary of Bulk Storage

Undyed Diesel

Gasoline Gallons

Gallons

a)

Beginning inventory:

b)

Received into storage:

(Page 6, Columns A and D)

c)

Total inventory:

( Add line (a) plus line (b))

d)

Ending inventory:

(Gallons remaining in storage)

e)

Total fuel dispensed:

(Subtract line (d) from line (c) )

f)

Portion of line (e) dispensed into vehicles:

( Enter on line 2 below)

g)

Portion of line (e) dispensed into equipment:

(Enter on line 9 below)

Compute Refund

Gasoline

Undyed

Note: If you are filing for off-road equipment only, begin on Line 9

1. Total miles traveled in all jurisdictions.

(Total miles driven, both on and off

Miles

Miles

public roads)

2. Total gallons dispensed from bulk storage into vehicles.

(From line (f)

Gal

Gal

above)

3. Total fuel used in vehicles at the pump.

Gal

Gal

(Page 6, Columns B and/or E )

4. Total gallons used in vehicles.

Gal

Gal

(Add line 2 plus line 3)

5. Average miles per gallon.

(Line 1 divided by line 4)

MPG

MPG

6. Total miles traveled on public roads in Montana.

(Total miles traveled on taxable

Miles

Miles

roads)

7. Total miles traveled off-road in Montana.

(From individual vehicle mileage records)

Miles

Miles

8. Gallons used off-road in Montana.

Gal

Gal

(Divide line 7 by line 5)

9.

Total gallons disbursed from bulk storage into equipment.

(From line (g) above)

Gal

Gal

10. Total gallons placed into equipment at the pump.

(Page 6, Columns C and/or F)

Gal

Gal

11. Total MT taxed gallons placed into equipment.

(Add line 9 plus line 10)

Gal

Gal

12. Total gallons subject to refund.

(

Add lines 8 and 11)

Gal

Gal

$

0.27

$

0.2775

13. Tax paid per gallon.

14. Amount of refund.

(

(Multiply line 12 by line 13)

Enter on line 12 of MF-Refund form page 1)

$

$

Attach this schedule to the application (MF-Refund form page 1)

Form Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23