Forms And Instructions For Application Form For Refund Of Montana Diesel Or Gasoline Tax Page 6

ADVERTISEMENT

16, 17, 18, 19, & 20: These lines must be filled only if you use a paid preparer.

21

Applicant’s Signature: Applicant’s signature or authorized representative. Must be original

signature. Stamped or photocopies will be returned as missing information.

22

Date: Date application signed.

23

Spouse’s Signature: This is required if the applicant filed a joint individual income tax return

and is applying for an agricultural refund on Schedule A.

24

Date: Date spouse signed application.

½

STEP 3:

Send in the completed form page 1 (MF-Refund) with appropriate schedule and attached

appropriate invoices.

Schedules A – Agricultural Standard Refund Instructions

This schedule needs to be attached to the Refund Application Form, (MF-Refund - form page 1), along with

your original bulk and cardtrol/keylock invoices as proof of purchase.

½ STEP 1:

You must first complete one of the following worksheets using your most recent income tax

return. The worksheet corresponds to federal and state income tax forms. Do not send

worksheet with the application.

t INDIVIDUAL Qualification Worksheet on page 5, for individual(s) or sole proprietor.

t PARTNERSHIP Qualification Worksheet on page 5, for partnerships.

t CORPORATION Qualification Worksheet on page 6, if you file as a corporation

½ STEP 2:

Make sure all of your invoices meet the invoice requirements on page 2.

½ STEP 3:

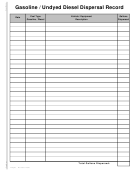

Go to the BACK of Schedule A. List all purchases of bulk storage and keylock/cardtrol.

List each group of invoices separately as indicated by the column headings. Make sure you

total the gasoline and undyed diesel columns after entering your fuel purchases.

½ STEP 4:

Go to the top FRONT of Schedule A and enter the name of the individual or business who

is applying for the refund & complete the following lines:

Line # - of Schedule A

1 Agricultural income percentage: Enter your percentage of agricultural income from the

worksheet.

2 Total gallons subject to refund: Enter gasoline & undyed diesel totals from columns on back of

Schedule A.

3 Standard deduction: Enter your standard deduction. If your percentage on line 1 is 50% or

more enter 60%; if between 40% & 49%, enter 50%; if between 30% & 39%, enter 40%. If less

than 30% you are not eligible but you may qualify under a different method, see page 1.

4 Gallons subject to refund: Multiply both totals on line 2 by your standard deduction and enter

on line 4.

5 Montana fuel tax paid per gallon: This is the current tax levied per gallon by law.

6 Total refund amount: Multiply line 4 by the amounts on line 5. These are the refund amounts

for both gasoline and undyed diesel.

½ STEP 5

: Transfer the amount(s) from line 6 of Schedule A onto line 11 of the Refund Application

Form (MF-Refund – form page 1).

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23