Forms And Instructions For Application Form For Refund Of Montana Diesel Or Gasoline Tax Page 4

ADVERTISEMENT

Definitions

Agricultural Use:

The use of gasoline and/or diesel, by a person who earns income while engaging in

the business of farming or ranching and who files farm/ranch income reports for tax purposes as

required by the Internal Revenue Service.

Bulk Delivery:

Placing gasoline or diesel in storage or containers. The term does not mean gasoline or

diesel delivered into the supply tank of a motor vehicle.

Bulk Delivery Invoice:

An invoice issued by a dealer for the purchase of fuel in storage.

Bulk Storage:

A container, except for the supply tank of a motor vehicle or any combustible engine, that

holds any fuel for storage.

Cardtrol or Keylock:

A unique device intended to allow access to a fuel dealer’s unattended pump or

dispensing unit for the purpose of delivery of fuel to an authorized user of the unique device.

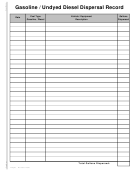

Dispersal Record:

A withdrawal record of fuel detailing the type of fuel withdrawn, the vehicle or

equipment the fuel was put into, the number of gallons dispersed and the date of dispersal. The

Dispersal Record is a required form to be kept in your files for Schedule B – Off-Road Refunds and

Schedule C – Power Take-Off Unit Refunds. A sample of a Dispersal Record is attached at the end of

this booklet for your use.

Farmer or Rancher:

A person who earns a living raising livestock, dairy, poultry, fruit and agricultural

commodities. The term also includes a person who cultivates and grows orchards. A farmer or rancher

is not regularly a person who earns a living raising fish, fur-bearing animals, horticultural commodities

or a feed yard for the fattening of cattle.

Gross Earned Income:

This includes income that you receive from working for another person

(wages), and the income, before expenses, that is earned when you are working for yourself or as a

partner. Earned income does not include passive income such as interest, dividends, capital gain etc.

Off-Road Usage:

When driving off-road, you are driving on private property and any road that does not

use public revenues for construction, reconstruction or improvement. Highways, county roads, city

streets and established public forest service roads are considered on-road.

Vehicle Mileage Log:

A detailed mileage account for a vehicle listing: Trip date, origin, destination,

beginning and ending odometer readings for on and off road and major roads traveled. A sample of a

vehicle mileage log is attached at the end of this booklet for your use. The Vehicle Mileage Log is a

required record to be kept in your files for Off-Road Refunds (Schedule B) and for Power Take-Off

Refunds (Schedule C).

Bulk Invoice Requirements

All 9 items are to be filled out by the dealer at the time of purchase:

1. Preprinted invoice number

2. Seller name and address

3. Purchaser name and address

ΠMust be same name as applicant.

ΠIf purchaser & applicant names are not similar, attach a signed statement declaring that the

names listed on the invoices & the applicant’s name are the same.

4. Date of delivery or purchase

5. What was fueled (slip tank, equipment, cans, barrel, cardtrol, keylock, etc)

6. Type of fuel

7. Gallons invoiced

8. Price per gallon

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23