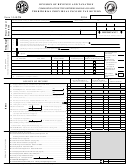

WORKSHEET A

SALARIES, WAGES, TIPS AND OTHER EMPLOYEE COMPENSATION

Column 1

Column 2

Column 3

Column 4

Column 5

City Where Employed

Income From Each Local W-2

2106 Expenses, If Any

Kettering Tax Withheld

*Other City Tax Withheld

Cannot Exceed 1.75%

Totals

Enter On:

Page 1 Line 1

Page 1 Line 2

Page 1 Line 7

Page 1 Line 8

*Income reduced by 2106 and earned in another city must also reduce the tax withheld for that city by the same percentage.

1. SCHEDULE C — Net Profit or Loss From Business or Profession (Attach Federal Schedule C)

Business Name ____________________________________________________Business Address ____________________________________________________________

Kind of Business ___________________________________________________ Date Started _____________________________ Date Ended _________________________

A. Net Profit or Loss ________________ Attach Schedule(s) C

B. Percentage Amount Apportioned to Kettering (From Schedule Y below) _____________________

C. Amount subject to tax. Multiply A times B. ________________________

TOTAL (1) $__________________________

Note: (If taxes paid to other cities, attach other cities’ returns)

Enter on Line A Below

2. SCHEDULE Y (Business Apportionment Formula)

A. Located

B. Located In

Everywhere

This City

C. Percentage (B÷A)

Step 1.

Original Cost Of Real & Tangible Personal Property

____________________ ____________________ ____________________ %

Gross Annual Rentals Paid Multiplied By 8

____________________ ____________________ ____________________ %

Total Step 1.

____________________ ____________________ ____________________ %

Step 2.

Gross Receipts From Sales Made And/Or Work Or Services

____________________ ____________________ ____________________ %

Performed

Step 3.

Wages, Salaries And Other Compensation Paid

____________________ ____________________ ____________________ %

4.

Total Percentages

____________________ ____________________ ____________________ %

5.

Average Percentages

____________________ %

Divide Total Percentages by Number of Percentages Used. Carry to Section 1, Line B Above_________________%

3. SCHEDULE E — INCOME FROM RENTS (Attach Federal Schedule E)

Property Address (Including City, State And Postal Code)

Net Profit/Loss

TOTAL (2) $__________________________

Enter on Line B Below

4. SCHEDULE O — OTHER INCOME NOT INCLUDED IN SCHEDULES C OR E (Attach Federal Schedules)

(Income From Partnerships, Estates, Trusts, Fees, Tips, Gambling Winnings, 1099-Misc., etc.)

Received From Name/I.D. Number Amount

For (Description and/or Location)

Amount

(Applicable Losses w/o Exact Locations Will Be Disallowed)

TOTAL (3) $__________________________

Enter on Line C Below

5. SUMMARY OF OTHER INCOME

A.

Profit From Any Business Owned (From Section 1, Line 1 Above)

A. ____________________

B.

Rental and/or Partnership Income (From Section 3, Line 2 Above)

B. ___________________

C.

Other Income (From Section 4, Line 3 Above)

C. ___________________

D.

Total Other Income (Add A, B and C)

D. $__________________

E.

Enter Loss Carryforward, if any from prior years

E. ___________________

F.

Net Other Income or Loss (Subtract E from D)

F. $__________________

If greater than zero, enter on Page 1 Line 4

RESET FORM

If less than zero, enter only on Line F as loss carryforward

1

1 2

2