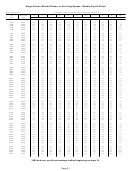

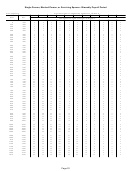

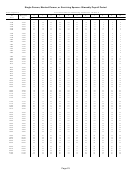

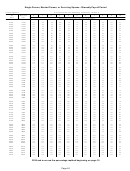

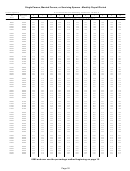

Form Nc-30 - Income Tax Withholding Tables And Instructions For Employers - North Carolina - 2017 Page 12

ADVERTISEMENT

17� Semiweekly Payments

required to pay electronically but you are interested in

doing so, please contact the EFT Section (toll-free) at

An employer who withholds an average of $2,000

1-877-308-9103. Local callers dial (919) 814-1501.

or more of North Carolina income tax per month must

pay the tax withheld at the same times it is required

20� Adjustments

to pay the tax withheld on the same wages for federal

You are liable to report and pay the correct amount

income tax purposes.

of tax to the Department even if, through error, you

deduct less than the correct amount from a wage

Each time you are required to deposit federal

payment. If you discover such an error, report and pay

employment taxes (income tax withheld and FICA),

the correct amount of tax to the Department and recover

you must remit the North Carolina income tax withheld

the amount due you from the employee by deducting

on those same wages. Exception: For federal tax

it from later payments to the employee or adjusting in

purposes, if an employer withholds $100,000 or more,

any other way agreeable to both of you.

the federal deposit is required on the next banking day.

North Carolina law did not adopt that provision of federal

If you deduct more than the correct amount of tax

law, and the State income tax withholding is due on

from any wage payment, you must report and pay to

or before the normal federal semiweekly due date for

the Department the actual amount withheld unless you

those wages. You must mail or deliver payment of the

repay the over-deducted amount to the employee or

North Carolina income tax withheld by the due date.

otherwise make applicable administrative adjustments

Payments are submitted with Form NC-5P, Withholding

and maintain records to show that you have done so.

Payment Voucher.

If you have reported an incorrect amount of tax, see

Form NC-5Q, North Carolina Quarterly Income

the instructions for amending or correcting the report in

Tax Withholding Return, reconciles the tax paid for

the coupon payment books.

the quarter with the tax withheld for the quarter. Form

NC-5Q must be filed each quarter on or before the last

21� Payment of Tax

day of the month following the close of the quarter.

Due dates for Form NC-5Q are the same as for your

North Carolina does not use a depository system

federal quarterly return (Federal Form 941). You have

for income tax withheld. The amount you withhold is

10 additional days to file Form NC-5Q if you made

deemed by law to be held in trust by you for the State

all your required payments during the quarter and no

of North Carolina.

additional tax is due. Detailed instructions are included

in the forms packet which is mailed each quarter.

Penalties. The penalty for failure to timely file

a withholding return is 5% of the tax due per month

18� Paying Withholding Tax

(maximum 25%). A penalty of 10 percent is required for

Electronically

failure to withhold or pay the tax when due. Interest is

due from the time the tax was due until paid. Criminal

You can file your North Carolina withholding return

penalties are provided for willful failure or refusal to

and pay the tax online. The Department of Revenue’s

withhold, file a return, or pay tax when due.

E-File system offers the convenience of paying the

tax 24 hours a day, 7 days a week. Payments can be

Relief for semiweekly filers. If a payment falls

made online by bank draft, MasterCard, or Visa. There

under the shortfall provisions of Federal Regulation

is no fee for bank drafts, but there is a convenience

31.6302-1, you are not subject to interest or penalty

fee for using MasterCard or Visa. The fee is $2.00

on the additional tax due.

for every $100.00 increment of tax payment. Visit the

Department’s website at www�dornc�com and search

Personal liability.

An employer who fails to

for online file and pay.

withhold or pay the amount required to be withheld is

personally and individually liable for such amounts,

19� Electronic Funds Transfer (EFT)

and the Department is required to assess the tax and

If you remit an average of at least $20,000 each

penalty against the employer. If an employer has failed

month in North Carolina withholding taxes, you are

to collect or pay over income tax withheld or required to

required to pay by electronic funds transfer (EFT).The

have been withheld, the tax not deducted or paid may

Department will notify you if you are required to make

be assessed against the responsible corporate officers

payments by electronic funds transfer. You will not

or other such responsible officer whenever such taxes

receive payment vouchers if you pay electronically.

cannot be immediately collected from the employer. The

However, you must continue to file Form NC-5Q, North

liability includes the tax not deducted or paid previously

Carolina Quarterly Income Tax Return, and Form NC-

assessed against the employer. More than one person

3, Annual Withholding Reconciliation. If you are not

may be liable as a person responsible for the payment

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46