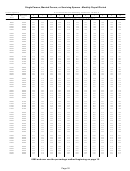

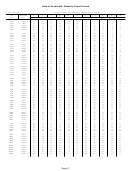

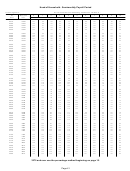

Form Nc-30 - Income Tax Withholding Tables And Instructions For Employers - North Carolina - 2017 Page 15

ADVERTISEMENT

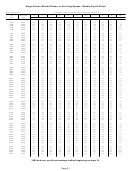

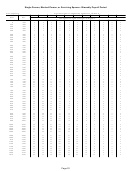

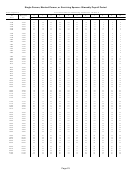

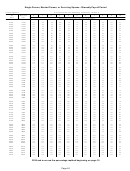

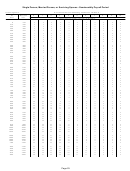

Percentage Method

- Formula Tables for Percentage Method Withholding Computations

(Round off the final result of calculations to the nearest whole dollar.)

Weekly Payroll Period

Single Person, Married Person, or Surviving Spouse

1.

Enter weekly wages

______________________

$168.27

2.

Weekly portion of standard deduction

_________________

3.

Multiply the number of allowances by $48.08

_________________

4.

Add lines 2 and 3

______________________

5.

Net weekly wages. Subtract line 4 from line 1

______________________

6.

Tax to be withheld. Multiply line 5 by .05599

______________________

Weekly Payroll Period

Head of Household

1.

Enter weekly wages

______________________

$269.23

2.

Weekly portion of standard deduction

_________________

3.

Multiply the number of allowances by $48.08

_________________

4.

Add lines 2 and 3

______________________

5.

Net weekly wages. Subtract line 4 from line 1

______________________

6.

Tax to be withheld. Multiply line 5 by .05599

______________________

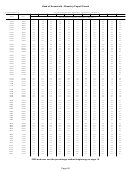

Biweekly Payroll Period

Single Person, Married Person, or Surviving Spouse

1.

Enter biweekly wages

______________________

$336.54

2.

Biweekly portion of standard deduction

_________________

3.

Multiply the number of allowances by $96.15

_________________

4.

Add lines 2 and 3

______________________

5.

Net biweekly wages. Subtract line 4 from line 1

______________________

6.

Tax to be withheld. Multiply line 5 by .05599

______________________

Biweekly Payroll Period

Head of Household

1.

Enter biweekly wages

______________________

$538.46

2.

Biweekly portion of standard deduction

_________________

3.

Multiply the number of allowances by $96.15

_________________

4.

Add lines 2 and 3

______________________

5.

Net biweekly wages. Subtract line 4 from line 1

______________________

6.

Tax to be withheld. Multiply line 5 by .05599

______________________

Page 15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46