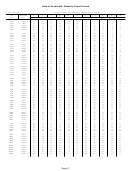

Form Nc-30 - Income Tax Withholding Tables And Instructions For Employers - North Carolina - 2017 Page 9

ADVERTISEMENT

has no provision requiring backup withholding.

their employer Form NC-4 EZ with line 4 checked. To

maintain the exemption, the employee must submit a

Farm labor. Farmers are required to withhold State

new Form NC-4 EZ each year. The Act does not apply

income tax from wages paid to agricultural workers if

to military spouses who are domiciled in North Carolina.

they are required to withhold tax for federal purposes.

Withholding from wages paid to military spouses

domiciled in North Carolina is still required.

See Federal Publication 15, Circular E, Employer’s

Tax Guide, for additional information regarding taxable

Seamen. The Vessel Worker Tax Fairness Act, 46

wages.

U.S.C., 11108, prohibits withholding of state income

tax from the wages of a seaman on a vessel engaged

11� Payments Exempt from

in foreign, coastwide, inter-coastal, interstate, or

Withholding

noncontiguous trade or an individual employed on a

fishing vessel or any fish processing vessel. Vessels

Employers are required to withhold on wages to the

engaged in other activity do not come under the

same extent required for federal income tax purposes.

restrictions; however, any seaman who is employed in

A recipient of any payments exempt from withholding is

coastwide trade between ports in this State may have

required to pay estimated income tax if the recipient’s

tax withheld if the withholding is pursuant to a voluntary

income meets the minimum requirements for filing.

agreement between such seaman and his employer.

If you and the individual wish to enter into a voluntary

Indian Reservation Income: Employers are not

agreement to withhold North Carolina tax, you must

required to withhold State income tax from wages

report and pay the amount withheld to the Department,

earned or received by an enrolled member of a federally

and the individual will receive credit on his income tax

recognized Indian tribe if such income is derived from

return provided you follow the rules which apply to

activities on a federally recognized Indian reservation

withholding. Since the agreement is voluntary, credit

while the member resided on the reservation. An

cannot be claimed for any amount withheld unless it

employee who meets these criteria should furnish their

is properly paid to the Department of Revenue. The

employer Form NC-4 EZ with line 3 checked. To maintain

individual should complete a withholding allowance

the exemption, the employee must submit a new Form

certificate, Form NC-4, NC-4 EZ, or NC-4 NRA, and

NC-4 EZ each year. Intangible income having a situs

request that the agreed amount be withheld.

on the reservation and retirement income associated

with activities on the reservation are considered income

Domestic employees. Employers are not required

derived from activities on the reservation.

to withhold State income tax from the wages of domestic

employees; however, the employer and employee may

enter into a voluntary agreement to withhold from the

12� Payroll Period

employee’s wages. Employers may wish to contact

See Federal Publication 15, Circular E, Employer’s

the Employment Security Commission regarding any

Tax Guide, for information on payroll period.

employment insurance liability.

13� Supplemental Wages

Military Spouses� The Military Spouses Residency

Relief Act of 2009 amended the Servicemembers Civil

If you pay supplemental wages separately (or

Relief Act (“SCRA”) to provide that a spouse shall neither

combine them with regular wages in a single payment

lose nor acquire domicile or residence in a state when

and specify the amount of each), the income tax

the spouse is present in the state solely to be with the

withholding method depends in part on whether you

servicemember in compliance with the servicemember’s

withhold income tax from your employee’s regular

military orders if the residence or domicile is the same

wages. If you withhold income tax from an employee’s

for both the servicemember and spouse.

regular wages, you can use one of these methods for

the supplemental wages:

The Act prohibits North Carolina from taxing the

income earned for services performed in North Carolina

(a) Withhold a flat 5.599%, or

by a spouse of a servicemember stationed in North

Carolina if (1) the servicemember is present in North

Carolina solely in compliance with military orders; (2)

(b) Add the supplemental and regular wages for

the spouse is in North Carolina solely to be with the

the most recent payroll period this year. Then figure

servicemember; and (3) the spouse is domiciled in

the income tax as if the total were a single payment.

the same state as the servicemember. If all three of

Subtract the tax already withheld from the regular wages.

the conditions are met, an employer is not required to

Withhold the remaining tax from the supplemental

withhold North Carolina tax from wages paid to such

wages. If you did not withhold income tax from the

military spouses if the employee has furnished to

employee’s regular wages, use method (b).

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

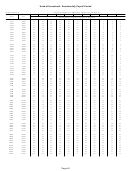

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46