Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 136

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

150 SUMMARY OF IMPROPER PAYMENTS

The Improper Payments Information Act (IPIA) of 2002 requires agencies to review their programs and activities to identify those

susceptible to significant improper payments. IPIA was amended on July 22, 2010, by the Improper Payments Elimination and Recovery

Act (IPERA) of 2010. IPERA strengthens the requirements for government agencies to carry out cost-effective programs for identifying

and recovering overpayments, also known as “recapture auditing.”

The Office of Management and Budget (OMB) Circular A-123, Appendix C, Requirements for Effective Measurement and Remediation

of Improper Payments provides guidance on the implementation of IPERA. OMB A-123, Appendix C defines an improper payment as any

payment that should not have been made or that was made in an incorrect amount under statutory, contractual, administrative, or other

legally applicable requirements. Incorrect amounts are overpayments or underpayments that are made to eligible recipients (including

inappropriate denials of payment or service, any payment that does not account for credit for applicable discounts, payments that are

for the incorrect amount, and duplicate payments). An improper payment also includes any payment that was made to an ineligible

recipient or for an ineligible good or service, or payments for goods or services not received (except for such payments authorized by

law). In addition, when an agency’s review is unable to discern whether a payment was proper as a result of insufficient or lack of

documentation, this payment must also be considered an improper payment.

FEDERAL AVIATION ADMINISTRATION (FAA) PROCESS

The FAA’s process for complying with IPERA and OMB Circular A-123, Appendix C, consists of the following steps:

1) Review program and activities to identify those susceptible to significant improper payments

2) Obtain a statistically valid estimate of the annual amount of improper payments in programs and activities for those programs

identified as susceptible to significant improper payments

3) Implement a plan to reduce erroneous payments

4) Report estimates of the annual amounts of improper payments in programs and activities and progress in reducing them

For FY 2013 reporting, the FAA conducted the above four-step process for the 12-month period of April 1, 2012 to March 31, 2013.

For FY 2013, we also developed a Do Not Pay Implementation Plan to be in compliance with the Improper Payments Elimination and

Recovery Improvement Act (IPERIA) of 2012 and provided a high-dollar quarterly report to the U.S. Department of Transportation (DOT)

Office of the Inspector General (OIG), OMB, and displayed on DOT website.

I. Risk Assessment

The FAA’s Programmatic Improper Payment Risk Assessment leverages the Assessable Units (AU) Risk Profiles compiled as part of the

ongoing compliance with the FMFIA. This assessment identified the Airport Improvement Program (AIP) as high-risk for FY 2013 due

to the volume of payments made annually, approximately $3.5 billion for AIP, coupled with the fact that federal funds within these

programs are further administrated outside the agency by local governments or airport sponsors. The FAA’s programmatic improper

payment risk assessment leverages the AU risk profiles compiled as part of ongoing compliance with the FMFIA of 1982.

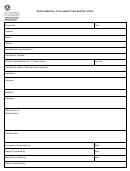

Table 1 lists the high-risk program name and the disbursements population selected for FY 2013 testing.

TABLE 1. HIGH-RISK PROGRAM SELECTED FOR TESTING

Operating Administration

Program Name

FY 2013 Disbursements (Based on Actual Data)

FAA

Airport Improvement Program (AIP)

$3,517,553,509.73

134

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business