Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 33

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

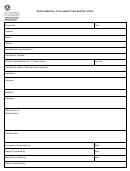

150 Composition of Liabilities

Liabilities Comparison

as of September 30, 2013

(Dollars in Thousands)

Employee related

9%

22%

and other liabilities

Federal employee

benefits

18%

Environmental

liabilities

34%

17%

Grants payable

Accounts payable

Accounts payable

Employee related and other

n

n

0

$ THOUSANDS

400,000

800,000

1,200,000

1,600,000

liabilities

Grants payable

n

2013

2012

n

n

Federal employee benefits

n

Environmental liabilities

n

Assets

assets, and capitalized real and personal property. There was

a decrease of $21.8 million in the total composition of PP&E as

Total assets were $31.4 billion as of September 30, 2013. The

purchases of equipment and additions to construction-in-progress

FAA’s assets are the resources available to pay liabilities or

through the normal course of business were less than the offsets

satisfy future service needs. The Composition of Assets chart

by retirements, disposals, and depreciation.

depicts major categories of assets as a percentage of total

assets.

Liabilities

The Assets Comparison chart presents comparisons of major

As of September 30, 2013, FAA reported liabilities of $4.4

asset balances as of September 30, 2012 and 2013.

billion. Liabilities are probable and measurable future outflows

of resources arising from past transactions or events. The

Fund balance with Treasury (FBWT) represents 10 percent of the

Composition of Liabilities chart depicts the FAA’s major

FAA’s current period assets and consists of funding available

categories of liabilities as a percentage of total liabilities.

through the Department of Treasury accounts from which the

FAA is authorized to make expenditures to pay liabilities. It also

The Liabilities Comparison chart presents comparisons of major

includes passenger ticket and other excise taxes deposited to the

liability balances between September 30, 2012 and September

Airport and Airway Trust Fund (AATF), but not yet invested. Fund

30, 2013. Below is a discussion of the major categories.

balance with Treasury increased from $3.1 billion to $3.3 billion.

At $1.5 billion, Employee related and other liabilities represent

At $13.8 billion, Investments represent 44 percent of the FAA’s

34 percent of FAA’s total liabilities. These liabilities decreased by

current period assets, and are derived from passenger ticket and

$64.1 million as of September 30, 2013 and are comprised mainly

other excise taxes deposited to the AATF and premiums collected

of $175.2 million in advances received, $201.3 million in Federal

from the Aviation Insurance Program. These amounts are used to

Employee’s Compensation Act payable, $452.2 million in accrued

finance the FAA’s operations to the extent authorized by Congress

payroll and benefits, $526.6 million in accrued leave and benefits,

and to pay potential insurance claims. Investments increased by

$2.7 million in legal claims liability and $78.0 million in capital

$1.5 billion due to an increase in excise tax revenues of $317.2

lease liability.

million, coupled with yearly War Risk premiums of $164.2 million,

and earned interest of $248.0 million. Additionally, investments

At $973.0 million, Federal employee benefits represent 22

are not liquidated until needed to fund expenses which accounts

percent of the FAA’s current year liabilities, and consist of the

for the remaining increase on a comparative basis.

FAA’s expected liability for death, disability, and medical costs

for approved workers compensation cases, plus a component

At $13.4 billion, General property, plant, and equipment, net

for incurred but not reported claims. The Department of Labor

(PP&E) represents 43 percent of the FAA’s assets as of September

(DOL) calculates the liability for the DOT, and the DOT attributes

30, 2013, and primarily comprises construction-in-progress

a proportionate amount to the FAA based upon actual workers’

related to the development of the national airspace system

compensation payments to the FAA employees over the

31

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business