Page 2 of 8

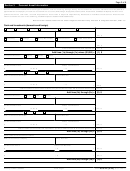

Section 3

Personal Asset Information

Use the most current statement for each type of account, such as checking, savings, money market and online accounts, stored value cards

(such as, a

, investment and retirement accounts

, life insurance

payroll card from an employer)

(IRAs, Keogh, 401(k) plans, stocks, bonds, mutual funds, certificates of deposit)

policies that have a cash value, and safe deposit boxes. Asset value is subject to adjustment by IRS based on individual circumstances. Enter the total

amount available for each of the following

(if additional space is needed include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(1a) $

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(1b) $

Total of bank accounts from attachment

(1c) $

Add lines (1a) through (1c) minus ($1,000) =

(1) $

Investment Account:

Stocks

Bonds

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

=

(2a) $

Investment Account:

Stocks

Bonds

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

=

(2b) $

Total investment accounts from attachment. [current market value X.8 minus loan balance(s)]

(2c) $

(2) $

Add lines (2a) through (2c) =

Retirement Account:

401K

IRA

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

(3a) $

=

Retirement Account:

401K

IRA

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

(3b) $

=

Total of retirement accounts from attachment. [current market value X .8 minus loan balance(s)]

(3c) $

Add lines (3a) through (3c) =

(3) $

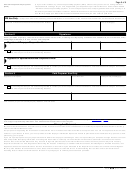

Cash Value of Life Insurance Policies

Name of Insurance Company

Policy Number

Current Cash Value

Minus Loan Balance

$

– $

(4a) $

=

Total cash value of life insurance policies from attachment

Minus Loan Balance(s)

$

– $

(4b) $

=

Add lines (4a) through (4b) =

(4) $

433-A (OIC)

Form

(Rev. 3-2017)

Catalog Number 55896Q

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32