APPLICATION CHECKLIST

Review the entire application using the Application Checklist below. Include this checklist with your application.

Forms 433-A (OIC),

Did you complete all fields and sign all forms?

433-B (OIC), and 656

Did you make an offer amount that is equal to the offer amount calculated on

the Form 433-A (OIC) or Form 433-B (OIC)? If not, did you describe the

special circumstances that are leading you to offer less than the minimum in

the “Explanation of Circumstances” Section 3 of Form 656, and did you

provide supporting documentation of the special circumstances?

Have you filed all required tax returns and received a bill or notice of balance

due?

Did you select a payment option on Form 656?

Did you sign and attach the Form 433-A (OIC), if applicable?

Did you sign and attach the Form 433-B (OIC), if applicable?

Did you sign and attach the Form 656?

If you are making an offer that includes business and individual tax debts, did

you prepare a separate Form 656 package (including separate financial

statements, supporting documentation, application fee, and initial payment)?

Supporting documentation

Did you include photocopies of all required supporting documentation?

and additional forms

If you want a third party to represent you during the offer process, did you

include a Form 2848 or Form 8821 unless one is already on file? Does it

include the current tax year?

Did you provide a letter of testamentary or other verification of person(s)

authorized to act on behalf of the estate or deceased individual?

Payment

Did you include a check or money order made payable to the “United States

Treasury” for the initial payment? (Waived if you meet Low Income

Certification guidelines—see Form 656.)

Did you include a separate check or money order made payable to the

“United States Treasury” for the $186 application fee? (Waived if you meet

Low Income Certification guidelines—see Form 656.)

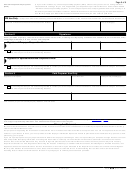

Mail your application package to

Mail the Form 656, 433-A (OIC) and/or 433-B (OIC), and related financial

the appropriate IRS facility

document(s) to the appropriate IRS processing office for your state. You may

wish to send it by Certified Mail so you have a record of the date it was mailed.

If you reside in:

Mail your application to:

Memphis IRS Center COIC Unit

AK, AL, AR, AZ, CO, FL, GA, HI, ID, KY, LA, MS, NC, NM,

P.O. Box 30803, AMC

NV, OK, OR, TN, TX, UT, WA, WI

Memphis, TN 38130-0803

1-866-790-7117

Brookhaven IRS Center COIC Unit

CA, CT, DE, IA, IL, IN, KS, MA, MD, ME, MI, MN, MO, MT,

P.O. Box 9007

ND, NE, NH, NJ, NY, OH, PA, RI, SC, SD, VT, VA, WY,

Holtsville, NY 11742-9007

WV; DC, PR, or a foreign address

1-866-611-6191

27

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32