Page 2 of 6

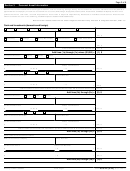

Section 2

Business Asset Information

Gather the most current statement from banks, lenders on loans, mortgages

, monthly payments, loan balances, and

(including second mortgages)

accountant's depreciation schedules, if applicable. Also, include make/model/year/mileage of vehicles and current value of business assets. To estimate

the current value, you may consult resources like Kelley Blue Book ( ), NADA

, local real estate postings of properties

( )

similar to yours, and any other websites or publications that show what the business assets would be worth if you were to sell them. Asset value is

subject to adjustment by IRS. Enter the total amount available for each of the following

.

(if additional space is needed, please include attachments)

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments

(domestic and foreign)

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(1a) $

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(1b) $

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(1c) $

Total bank accounts from attachment

(1d) $

Add lines (1a) through (1d) =

(1) $

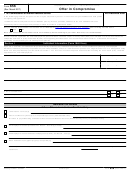

Investment Account:

Stocks

Bonds

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

(2a) $

=

Investment Account:

Stocks

Bonds

Other

Name of Financial Institution

Account Number

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

=

(2b) $

Total investment accounts from attachment. [current market value X.8 minus loan balance(s)]

(2c) $

Add lines (2a) through (2c) =

(2) $

Notes Receivable

Do you have notes receivable?

Yes

No

If yes, attach current listing which includes name, age, and amount of note(s) receivable.

Accounts Receivable

Do you have accounts receivable, including e-payment, factoring

Yes

No

companies, and any bartering or online auction accounts?

If yes, you may be asked to provide a list of name, age, and amount of the account(s) receivable.

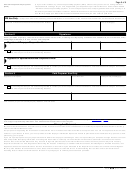

433-B (OIC)

Form

(Rev. 3-2017)

Catalog Number 55897B

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32