Page 6 of 8

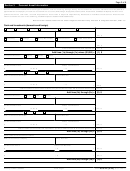

Section 7

Monthly Household Income and Expense Information

Enter your household's gross monthly income. The information below is for yourself, your spouse, and anyone else who contributes to

your household's income. The entire household includes spouse, non-liable spouse, significant other, children, and others who

contribute to the household. This is necessary for the IRS to accurately evaluate your offer.

Monthly Household Income

Note: Entire household income should also include income that is considered not taxable and may not be included on your

tax return.

Round to the nearest whole dollar.

Primary taxpayer

Gross Wages

Social Security

Pension(s)

Other Income

(e.g. unemployment)

Total primary

$

+ $

+ $

+ $

(30) $

taxpayer income =

Spouse

Gross Wages

Social Security

Pension(s)

Other Income

(e.g. unemployment)

Total spouse

$

+ $

+ $

+ $

(31) $

income =

Additional sources of income used to support the household, e.g., non-liable spouse, or anyone else who may

contribute to the household income, etc.

(32) $

Interest and dividends

(33) $

Distributions

(34) $

(e.g., income from partnerships, sub-S Corporations, etc.)

Net rental income

(35) $

Net business income from Box C

(36) $

Child support received

(37) $

Alimony received

(38) $

Box D

Round to the nearest whole dollar.

Total Household Income

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

$

Add lines (30) through (38) and enter the amount in Box D =

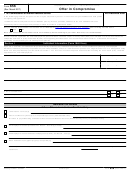

Monthly Household Expenses

Enter your average monthly expenses.

Note: For expenses claimed in boxes (39) and (45) only, you should list the full amount of the allowable standard even if the

actual amount you pay is less. You may find the allowable standards at

Self-Employed/Collection-Financial-Standards.

Round to the nearest whole dollar.

Food, clothing, and miscellaneous

(e.g., housekeeping supplies, personal care products , minimum payment on credit card).

A reasonable estimate of these expenses may be used.

(39) $

Housing and utilities

(e.g., rent or mortgage payment and average monthly cost of property taxes, home insurance,

maintenance, dues, fees and utilities including electricity, gas, other fuels, trash collection, water, cable television and internet,

telephone, and cell phone).

(40) $

Vehicle loan and/or lease payment(s)

(41) $

Vehicle operating costs

(e.g., average monthly cost of maintenance, repairs, insurance, fuel, registrations, licenses,

. A reasonable estimate of these expenses may be used.

inspections, parking, tolls, etc.)

(42) $

Public transportation costs

(e.g., average monthly cost of fares for mass transit such as bus, train, ferry, taxi, etc.). A

reasonable estimate of these expenses may be used.

(43) $

Health insurance premiums

(44) $

Out-of-pocket health care costs

(e.g. average monthly cost of prescription drugs, medical services, and medical supplies like

eyeglasses, hearing aids, etc.)

(45) $

Court-ordered payments

(46) $

(e.g., monthly cost of any alimony, child support, etc.)

Child/dependent care payments

(47) $

(e.g., daycare, etc.)

Life insurance premiums

(48) $

Current monthly taxes

(49) $

(e.g., monthly cost of federal, state, and local tax, personal property tax, etc.)

433-A (OIC)

Form

(Rev. 3-2017)

Catalog Number 55896Q

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32