Page 4 of 8

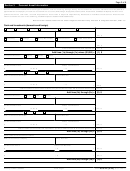

Section 3

Personal Asset Information

(Continued)

Other valuable items

(artwork, collections, jewelry, items of value in safe deposit boxes, interest in a company or business that is not publicly traded, etc.)

Note: Do not include clothing, furniture and other personal effects.

Description of asset:

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

=

(7a) $

Description of asset:

Current Market Value

Minus Loan Balance

$

X .8 = $

– $

(7b) $

=

Total value of valuable items listed from attachment [current market value X .8 minus any loan balance(s)]

(7c) $

Add lines (7a) through (7c) =

(7) $

Box A

Available Individual Equity in

Do not include amount on the lines with a letter beside the number. Round to the nearest whole dollar.

Assets

Do not enter a negative number. If any line item is a negative, enter "0" on that line.

$

Add lines (1) through (7) and enter the amount in Box A =

NOTE: If you or your spouse are self-employed, Sections 4, 5, and 6 must be completed before continuing with Sections 7 and 8.

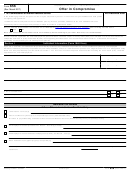

Section 4

Self-Employed Information

If you or your spouse are self-employed (e.g., files Schedule(s) C, E, F, etc.), complete this section.

Is your business a sole proprietorship?

Address of Business

(If other than personal residence)

Yes

No

Name of Business

Employer Identification Number

Business Website

Trade Name or DBA

Business Telephone Number

(

)

-

Description of Business

Total Number of Employees

Frequency of Tax Deposits

Average Gross Monthly

Payroll $

Do you or your spouse have any other business interests? Include any

Business Address

(Street, City, State, ZIP code)

interest in an LLC, LLP, corporation, partnership, etc.

Yes

Title:

(Percentage of ownership:

)

No

Business Name

Employer Identification Number

Business Telephone Number

(

)

-

Type of business

(Select one)

Partnership

LLC

Corporation

Other

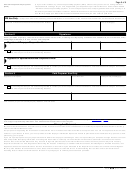

Section 5

Business Asset Information (for Self-Employed)

List business assets such as bank accounts, tools, books, machinery, equipment, business vehicles and real property that is owned/leased/rented. If

additional space is needed, attach a list of items. Do not include personal assets listed in Section 3.

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(8a) $

Cash

Checking

Savings

Money Market/CD

Online Account

Stored Value Card

Bank Name

Account Number

(8b) $

Total bank accounts from attachment

(8c) $

Add lines (8a) through (8c) =

(8) $

433-A (OIC)

Form

(Rev. 3-2017)

Catalog Number 55896Q

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32