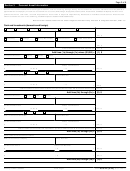

Department of the Treasury — Internal Revenue Service

433-B (OIC)

Form

Collection Information Statement for Businesses

(Rev. March 2017)

Complete this form if your business is a

► Corporation

► Limited Liability Company (LLC) classified as a corporation

► Partnership

► Other multi-owner/multi-member LLC

Note: If your business is a sole proprietorship or a disregarded single member LLC taxed as a sole proprietor (filing Schedule C, D, E, F, etc.),

do not use this form. Instead, complete Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-Employed Individuals.

This form should only be used with the Form 656, Offer in Compromise.

Include attachments if additional space is needed to respond completely to any question.

Section 1

Business Information

Business Name

Employer Identification Number

Business Physical Address

County of Business Location

(street, city, state, zip code)

Description of Business and DBA or "Trade Name"

Primary Phone

Secondary Phone

Business Mailing Address

(if different from above or Post Office Box number)

(

)

-

(

)

-

Business website address

Fax Number

Does the business outsource its payroll processing and tax return

preparation for a fee?

(

)

-

If yes, list provider name and address in box below

Yes

No

Federal Contractor

Total Number of Employees

(Street, City, State, ZIP Code)

Yes

No

Frequency of Tax Deposits

Average Gross Monthly Payroll

$

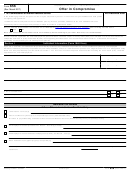

Provide information about all partners, officers, LLC members, major shareholders (foreign and domestic), etc., associated with the business.

Include attachments if additional space is needed.

Last Name

First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Home Address

(Street, City, State, ZIP Code)

-

-

Primary Phone

Secondary Phone

(

)

-

(

)

-

Last Name

First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Home Address

(Street, City, State, ZIP Code)

-

-

Primary Phone

Secondary Phone

(

)

-

(

)

-

Last Name

First Name

Title

Percent of Ownership and Annual Salary

Social Security Number

Home Address

(Street, City, State, ZIP Code)

-

-

Primary Phone

Secondary Phone

(

)

-

(

)

-

433-B (OIC)

Form

(Rev. 3-2017)

Catalog Number 55897B

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32