Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 11

ADVERTISEMENT

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

to year 2013 by any year 2012 tax payment

Exception to the General Rule: Your

ing Ohio paper returns: individual income

that you made after April 15, 2013.

spouse does not have to sign a married

tax, school district income tax, withholding

fi ling jointly return only if all three of the

tax (employer and pass-through entity)

If you don't meet either of the tests above, you

following apply:

and corporation franchise tax. See Ohio

must timely pay enough estimated Ohio in-

Your spouse resided outside Ohio for the

Revised Code sections 5703.262(B) and

come tax so that the sum of (i) your year 2012

entire year; AND

5747.08(F).

overpayment credited to year 2013, (ii) your

Your spouse did not earn any income in

year 2013 withholdings and (iii) your timely

Exception: The paid preparer should print

Ohio; AND

made estimated Ohio income tax payments

(rather than write) his/her name on the form

Your spouse did not receive any income

is not less than either of the two tests above.

if the taxpayer checks "Yes" to the question,

in Ohio.

"Do you authorize your preparer to contact

Common examples of income sources that

See Ohio Administrative Code (Ohio Rule)

us regarding this return?"

make quarterly estimated payments neces-

5703-7-18, which is on our Web site at

Can My Tax Preparer Contact the Tax

sary are self-employment income, pensions,

tax.ohio.gov.

commissions, lump sum payments, capital

Department About My Tax Return?

Do I Have To File a School District

gains, dividends, interest, alimony received

Income Tax Form?

or other sources of income not subject to

Yes. Just check the "Yes" box below your tax

withholding.

preparer's name on the bottom of page 2 of

Many Ohio school districts have an ad-

Ohio form IT 1040EZ or IT 1040. By check-

If you are required to make estimated pay-

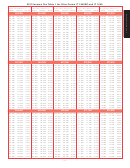

ditional income tax. These school districts

ing the "Yes" box, you are authorizing your

ments and do not, you may be subject to

are marked with an asterisk (*) on pages

preparer to contact the Ohio Department

an interest penalty on your underpayment

43-48. If during 2012 you were a full-year

of Taxation concerning questions that arise

of estimated taxes.

or part-year Ohio domiciliary and you either

during the processing of your Ohio income

lived in or were domiciled in one of these

tax return.

Quarterly estimated payments can be

districts during all or part of the year, then

made electronically on our Web site at

Checking "Yes" also authorizes your pre-

by the due date for fi ling your Ohio income

tax.ohio.gov. Or you can obtain Ohio form

parer to provide the department with infor-

tax return you must also fi le an Ohio form

IT 1040ES from our Web site at tax.ohio.gov

mation that is missing from the return, to

SD 100, School District Income Tax Return,

or by calling toll-free 1-800-282-1782.

contact the department for information about

with the Ohio Department of Taxation. You

the processing of the return or the status of

can electronically fi le your school district

2013 Estimated Tax Payment Due Dates

your refund or payments, and to respond

return or you can get Ohio form SD 100 from

1st quarter – April 15, 2013

to mathematical error notices, offsets and

our Web site at tax.ohio.gov, from your lo-

2nd quarter – June 17, 2013

return preparation notices that you have

cal school board offi ce or by calling toll-free

3rd quarter – Sept. 16, 2013

received from the department and have

1-800-282-1782.

4th quarter – Jan. 15, 2014

shown your preparer.

Do I Need To Enclose a Copy of My

TIP – If you don't want to make estimated

Should I Make Estimated Tax

Federal Income Tax Return?

payments, increase the amount of Ohio

Payments in 2013?

tax that your employer withholds from

Enclose a copy of your federal income tax

your wages. To do this, fi le a revised

You have to make estimated Ohio income

return if the amount shown on line 1 on page

Ohio form IT 4, Employee's Withhold-

tax payments for year 2013 only if the sum

1 of Ohio form IT 1040EZ or IT 1040 is zero

ing Exemption Certifi cate (available at

of (i) your year 2012 overpayment credited

or a negative amount.

tax.ohio.gov) with your employer.

to year 2013 (see line 24 on page 2 of form

Does Ohio Follow the Alternative

IT 1040) and (ii) your year 2013 Ohio income

Where Can I Find the Ohio Law

Preparer Signature Procedures?

tax withholding is not equal to or greater than

References About Income Taxes?

either of the following:

The Ohio Department of Taxation follows

100% of the year 2012 Ohio income tax

To see the sections of the Ohio Revised

IRS Notice 2004-54, which provides for

(see page 2 of Ohio form IT 1040: line 15

Code that relate to the line items on Ohio

alternative preparer signature procedures

minus line 22); OR

form IT 1040, go to our Web site at:

for federal income tax paper returns that

90% of the year 2013 tax.

paid practitioners prepare on behalf of their

For purposes of these tests, you must re-

clients. Paid preparers must follow those

references.stm.

duce your year 2012 overpayment credited

same procedures with respect to the follow-

- 11 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64