Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 19

ADVERTISEMENT

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

purchase(s) that you made in 2012 (for

you paid after the due date. Interest is due

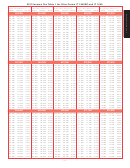

If your Ohio taxable

example, mail order or Internet purchases).

on late-paid tax even if the IRS has granted

income (line 5) is:

Your credit is:

Complete the worksheet on page 33. A

you a fi ling extension. The interest rate for

detailed explanation of the Ohio use tax is

calendar year 2013 is 3%.

$25,000 or less

on page 32.

..................................... 20% of line 10a

Penalty may be due on late-fi led returns

More than $25,000,

EZ Line 16 – Ohio Income Tax Withheld

and/or late-paid tax. For more information,

but not more than $50,000

see page 12.

..................................... 15% of line 10a

Enter the total amount of Ohio income tax

More than $50,000,

EZ Line 22 – Amount Due Plus Interest

withheld. This is normally shown on your tax

but not more than $75,000

and Penalty

statement form (W-2, box 17; W-2G, box 14;

..................................... 10% of line 10a

or 1099-R, box 12). See the sample W-2 and

More than $75,000

Add lines 20 and 21 to calculate the amount

W-2G on page 16 and the sample 1099-R

....................................... 5% of line 10a

you owe.

on page 17.

The credit is limited to a maximum of

Do not mail cash.

Place legible state copies of your W-2(s),

$650.

Make payment by electronic check or

W-2G(s) or 1099-R(s) on top of Ohio form

credit card (see page 8); OR

IT 1040EZ. Do not staple, tape or glue.

Example 2: If your Ohio taxable income (line

Make your paper check or money order

You cannot claim on the Ohio return any

5) is $20,000 and the amount on line 10a is

payable to Ohio Treasurer of State. Write

taxes withheld for another state, a city or

$303, then the joint fi ling credit will be $61:

your Social Security number on your

a school district.

paper check or money order and include

If you are a direct or indirect investor in a

$303 – from line 10a

Ohio form IT 40P (see our Web site at

pass-through entity, you cannot claim on

x .20 – from table above

tax.ohio.gov) and your payment with

this line taxes withheld on your behalf by

Ohio form IT 1040EZ.

a pass-through entity. For proper report-

Joint fi ling credit = $61 (rounded)

ing of taxes withheld on your behalf by

If you cannot pay the amount you owe, you

a pass-through entity, use Ohio form IT

If you qualify for this credit, but you and your

still must fi le the return by April 15, 2013 to

1040 and see line 21b on page 22.

spouse do not each have a W-2 form show-

avoid the late fi ling penalty (for an exception,

ing $500 or more of income, then you must

EZ Line 18 – Donations

see "Income Taxes and the Military" on page

include with the return a separate statement

14). For additional information regarding

explaining the income that qualifi es for this

payments, see page 8.

A donation will reduce the amount

credit. You must show that each spouse has

STOP

of the refund that you are due. If

$500 or more of qualifying income included

EZ Line 23 – Your Refund

you decide to donate, this deci-

in Ohio adjusted gross income (line 3) in

sion is fi nal. If you do not want to donate,

order to take the joint fi ling credit.

This is your refund after any reduction on line

leave lines 18a-d blank. If you do not have

21. If line 21 is more than the overpayment

an overpayment on line 17 but you want

EZ Line 13 – Interest Penalty

shown on line 19, you will have an amount

to donate, you may do so by writing a

due. Enter this amount on line 22 and follow

check and mailing it directly to the fund.

If line 12 minus the withholding shown on

the instructions.

See page 34 for more information.

line 16 is $500 or less, enter -0- on line 13.

If line 12 minus the withholding shown on

If you move after fi ling your

EZ Line 21 – Interest and Penalty Due

line 16 is greater than $500, you may owe

tax return and are expecting a

!

an interest penalty. You must complete Ohio

refund, notify the post offi ce

Except for certain military servicemembers

form IT/SD 2210 to determine if a penalty is

servicing your old address

CAUTION

(see "Income Taxes and the Military" on

due. This form is available on our Web site

by fi lling out a change-of-ad-

page 14), interest is due from April 16, 2013

at tax.ohio.gov.

dress form. This does not guarantee that

until the date the tax is paid.

your refund will be forwarded because

EZ Line 14 – Unpaid Use (Sales) Tax

post offi ces are not required to forward

If you fi le your return after the due date and

government checks. You should also

you paid and/or will pay any tax after the due

Use line 14 of Ohio form IT 1040EZ to re-

notify our department of your address

date, you owe interest unless the refund, if

port the amount of unpaid use (sales) tax,

change.

any, shown on line 23 is more than any tax

if any, that you may owe from out-of-state

- 19 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64