Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 4

ADVERTISEMENT

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

Ohio's Tax Amnesty Program for Consumer's Use Tax

The Ohio Department of Taxation has the responsibility for admin-

sales tax. In general, you either pay sales tax to a vendor or self-

istering the use tax amnesty program and accompanying educa-

assess and remit use tax to the Ohio Department of Taxation for

tional efforts meant to raise awareness of the amnesty opportunity

taxable purchases of tangible personal property or certain servic-

and help you better understand Ohio’s tax laws.

es used, stored or otherwise consumed in Ohio.

The use tax amnesty program runs from Oct. 1, 2011 through May

The department has developed a series of fact sheets explain-

1, 2013. It is for use tax due on purchases made by businesses on

ing how use tax commonly applies in specifi c types of business-

or after Jan. 1, 2009.

es such as construction contractors, manufacturing, retail and

service-related enterprises.

The program is intended to be helpful to Ohio businesses that may

be unaware of the use tax or are behind in meeting use tax obliga-

For more information or to view the fact sheets, visit our Web

tions. Under this amnesty, businesses not registered for use tax

site at tax.ohio.gov or call toll-free 1-800-304-3211, 8 a.m. until

can pay their past use tax liability without incurring penalties or

5 p.m., Monday through Friday. We encourage you to take ad-

interest. A no-interest payment plan is available to taxpayers with

vantage of this amnesty opportunity to eliminate any overdue tax

use tax liabilities exceeding $1,000.

liabilities that you may have.

If you are unfamiliar with the use tax, some brief background: Use

tax was passed into law in the 1930s as a companion tax to the

Highlights for 2012

N

Income Tax Online Services. Create a user name and

Taxation will no longer mail its estimated payment vouchers (Ohio

EW

password through our secure site for the following self-help

forms IT 1040ES and SD 100ES). Taxpayers may pay their quarterly

services:

2013 Ohio and/or school district estimated income tax by using any

Electronically view your 1099-G and/or 1099-INT form(s)

of our electronic payment methods. Taxpayers may also go to our

Go paperless with your 1099-G and/or 1099-INT form(s)

Web site at tax.ohio.gov to print copies of our forms.

(confi rmed e-mail address required)

N

E-Mail Notifi cation. The Ohio Department of Taxation has

EW

Update your profi le to include:

created a space on its Ohio form IT 1040 and IT 1040EZ that allows

– Address, phone number and e-mail address

the taxpayer to fi ll out an e-mail address. Also, through our new

For more information on these new services, as well as information

Online Services, you are able to provide, update and select "e-mail"

on your electronic fi le and pay options, go to our Web site at

as your preferred method of communication with the department for

tax.ohio.gov.

certain notices. No confi dential information will be included in e-mail

communications.

N

HB 508. In June 2012 the governor signed HB 508, which

EW

Pell Grant and Ohio College Opportunity Grant Deduction. Ohio

includes the following:

taxpayers may now be eligible for a deduction of limited taxable grant

Requires electronic fi ling for paid preparers that fi le 12 or more

amounts ..................................................................See page 26, 27

returns during any calendar year that begins on or after Jan. 1,

2013 (if they fi led 11 or more returns in the previous year).

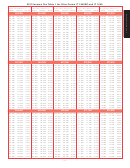

Ohio Income Tax Tables. Ohio's individual income tax brackets

Gives the tax commissioner the ability to send tax notices

have been indexed for infl ation per Ohio Revised Code section

electronically.

5747.025. The income tax brackets refl ect a 2.1% reduction

Expands the $50 penalty for dishonored/declined payments to

compared to taxable year 2011 ........................ See pages 35-41

now include those that are paid electronically.

Direct Deposit. Direct deposit options have been expanded for

N

HB 365. Upon the governor's signature, HB 365 expands

EW

electronic fi ling to allow taxpayers to split direct deposits into three

the 179/168 add-backs and deductions.

different accounts ........................................................ See page 7

N

Expansion of Job Creation and Retention Credit. On June

EW

Larger Personal Exemption. The personal and dependent income

6, 2012, the governor signed HB 327 expanding the job creation

tax exemption increased to $1,700 for the 2012 taxable year, up

and retention credit to now include home-based employees when

from $1,650 for 2011.

calculating the credit. See HB 327 for additional information.

Low Income Tax Credit. Taxpayers whose Ohio taxable income

N

EW

Estimated Payment Vouchers. Taking yet another step to

is $10,000 or less are entitled to a tax credit that results in a zero

streamline operations and reduce costs, the Ohio Department of

tax liability.

- 4 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64