Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 41

ADVERTISEMENT

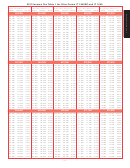

2012 Income Tax Table 1 for Ohio Forms IT 1040EZ and IT 1040

If your line 5 amount is:

If your line 5 amount is:

If your line 5 amount is:

If your line 5 amount is:

If your line 5 amount is:

At least:

Less than:

Ohio tax:

At least:

Less than:

Ohio tax:

At least:

Less than:

Ohio tax:

At least:

Less than:

Ohio tax:

At least:

Less than:

Ohio tax:

$90,000

$92,000

$94,000

$96,000

$98,000

$90,000

$90,050 $3,126

$96,000

$96,050 $3,408

$92,000

$92,050 $3,220

$94,000

$94,050 $3,314

$98,000

$98,050 $3,502

90,050

90,100

3,128

92,050

92,100

3,222

94,050

94,100

3,316

96,050

96,100

3,410

98,050

98,100

3,504

90,100

90,150

3,131

92,100

92,150

3,225

94,100

94,150

3,319

96,100

96,150

3,412

98,100

98,150

3,506

90,150

90,200

3,133

96,150

96,200

3,415

98,150

98,200

3,509

92,150

92,200

3,227

94,150

94,200

3,321

90,200

90,250

3,135

96,200

96,250

3,417

92,200

92,250

3,229

94,200

94,250

3,323

98,200

98,250

3,511

90,250

90,300

3,138

92,250

92,300

3,232

94,250

94,300

3,326

96,250

96,300

3,420

98,250

98,300

3,513

90,300

90,350

3,140

96,300

96,350

3,422

98,300

98,350

3,516

92,300

92,350

3,234

94,300

94,350

3,328

90,350

90,400

3,143

96,350

96,400

3,424

92,350

92,400

3,236

94,350

94,400

3,330

98,350

98,400

3,518

90,400

90,450

3,145

92,400

92,450

3,239

94,400

94,450

3,333

96,400

96,450

3,427

98,400

98,450

3,520

90,450

90,500

3,147

92,450

92,500

3,241

94,450

94,500

3,335

96,450

96,500

3,429

98,450

98,500

3,523

90,500

90,550

3,150

96,500

96,550

3,431

98,500

98,550

3,525

92,500

92,550

3,243

94,500

94,550

3,337

90,550

90,600

3,152

92,550

92,600

3,246

94,550

94,600

3,340

96,550

96,600

3,434

98,550

98,600

3,528

90,600

90,650

3,154

92,600

92,650

3,248

94,600

94,650

3,342

96,600

96,650

3,436

98,600

98,650

3,530

90,650

90,700

3,157

96,650

96,700

3,438

98,650

98,700

3,532

92,650

92,700

3,251

94,650

94,700

3,344

90,700

90,750

3,159

96,700

96,750

3,441

92,700

92,750

3,253

94,700

94,750

3,347

98,700

98,750

3,535

90,750

90,800

3,161

92,750

92,800

3,255

94,750

94,800

3,349

96,750

96,800

3,443

98,750

98,800

3,537

90,800

90,850

3,164

96,800

96,850

3,445

98,800

98,850

3,539

92,800

92,850

3,258

94,800

94,850

3,351

90,850

90,900

3,166

96,850

96,900

3,448

92,850

92,900

3,260

94,850

94,900

3,354

98,850

98,900

3,542

90,900

90,950

3,168

92,900

92,950

3,262

94,900

94,950

3,356

96,900

96,950

3,450

98,900

98,950

3,544

90,950

91,000

3,171

92,950

93,000

3,265

94,950

95,000

3,358

96,950

97,000

3,452

98,950

99,000

3,546

$91,000

$93,000

$95,000

$97,000

$99,000

$91,000

$91,050 $3,173

$97,000

$97,050 $3,455

$93,000

$93,050 $3,267

$95,000

$95,050 $3,361

$99,000

$99,050 $3,549

91,050

91,100

3,175

93,050

93,100

3,269

95,050

95,100

3,363

97,050

97,100

3,457

99,050

99,100

3,551

91,100

91,150

3,178

97,100

97,150

3,459

99,100

99,150

3,553

93,100

93,150

3,272

95,100

95,150

3,366

91,150

91,200

3,180

97,150

97,200

3,462

93,150

93,200

3,274

95,150

95,200

3,368

99,150

99,200

3,556

91,200

91,250

3,182

93,200

93,250

3,276

95,200

95,250

3,370

97,200

97,250

3,464

99,200

99,250

3,558

91,250

91,300

3,185

93,250

93,300

3,279

95,250

95,300

3,373

97,250

97,300

3,466

99,250

99,300

3,560

91,300

91,350

3,187

97,300

97,350

3,469

99,300

99,350

3,563

93,300

93,350

3,281

95,300

95,350

3,375

91,350

91,400

3,189

97,350

97,400

3,471

93,350

93,400

3,283

95,350

95,400

3,377

99,350

99,400

3,565

91,400

91,450

3,192

93,400

93,450

3,286

95,400

95,450

3,380

97,400

97,450

3,474

99,400

99,450

3,567

91,450

91,500

3,194

97,450

97,500

3,476

99,450

99,500

3,570

93,450

93,500

3,288

95,450

95,500

3,382

91,500

91,550

3,197

97,500

97,550

3,478

93,500

93,550

3,290

95,500

95,550

3,384

99,500

99,550

3,572

91,550

91,600

3,199

93,550

93,600

3,293

95,550

95,600

3,387

97,550

97,600

3,481

99,550

99,600

3,574

91,600

91,650

3,201

93,600

93,650

3,295

95,600

95,650

3,389

97,600

97,650

3,483

99,600

99,650

3,577

91,650

91,700

3,204

97,650

97,700

3,485

99,650

99,700

3,579

93,650

93,700

3,297

95,650

95,700

3,391

91,700

91,750

3,206

93,700

93,750

3,300

95,700

95,750

3,394

97,700

97,750

3,488

99,700

99,750

3,582

91,750

91,800

3,208

93,750

93,800

3,302

95,750

95,800

3,396

97,750

97,800

3,490

99,750

99,800

3,584

91,800

91,850

3,211

97,800

97,850

3,492

99,800

99,850

3,586

93,800

93,850

3,305

95,800

95,850

3,398

91,850

91,900

3,213

97,850

97,900

3,495

93,850

93,900

3,307

95,850

95,900

3,401

99,850

99,900

3,589

91,900

91,950

3,215

93,900

93,950

3,309

95,900

95,950

3,403

97,900

97,950

3,497

99,900

99,950

3,591

91,950

92,000

3,218

97,950

98,000

3,499

99,950

100,000

3,593

93,950

94,000

3,312

95,950

96,000

3,405

2012 Income Tax Table 2 for Ohio Forms IT 1040EZ and IT 1040

The income tax tables refl ect a 2.1% reduction compared to taxable year 2011.

Taxpayers with Ohio taxable income of $100,000 or more must use this table. You must round your tax to the nearest dollar.

Ohio Taxable Income

2012 Ohio Tax

(from line 5 of Ohio form IT 1040EZ or IT 1040)

(enter on line 6 of Ohio form IT 1040EZ or IT 1040)

0.587%

of Ohio taxable income

0

–

$

5,200

$

5,200

–

$ 10,400

$

30.52

plus

1.174%

of the amount in excess of $

5,200

$

91.57

plus

2.348%

of the amount in excess of $ 10,400

$ 10,400

–

$ 15,650

$

214.84

plus

2.935%

of the amount in excess of $ 15,650

$ 15,650

–

$ 20,900

$ 20,900

–

$ 41,700

$

368.93

plus

3.521%

of the amount in excess of $ 20,900

$ 41,700

–

$ 83,350

$ 1,101.30

plus

4.109%

of the amount in excess of $ 41,700

$ 2,812.70

plus

4.695%

of the amount in excess of $ 83,350

$ 83,350

–

$104,250

$ 3,793.96

plus

5.451%

of the amount in excess of $104,250

$104,250

–

$208,500

$ 9,476.63

plus

5.925%

of the amount in excess of $208,500

more than

–

$208,500

- 41 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64