Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 53

ADVERTISEMENT

Retain for your records.

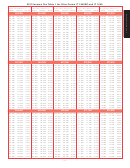

2012 Ohio Income Tax TeleFile Worksheet

DO NOT MAIL!

1a. Enter your Ohio fi ling status, which must be the same as your federal fi ling status.

Single or head of household or qualifying widow(er)

Married fi ling jointly

Married fi ling separately

1b. Read the information on page Tel 1 to see if you qualify to TeleFile. Ohio TeleFile has new security enhancements and

will ask you to enter additional personal information to identify you and, if applicable, your spouse. If you have changed

your address, call the Ohio Department of Taxation at 1-800-282-1780 to update your address and ZIP code before using

TeleFile. Enter your Social Security number, then date of birth in MM/DD/YYYY format and your ZIP code. If married fi ling

jointly, enter your spouse's Social Security number and date of birth in MM/DD/YYYY format.

ZIP code

Your Social Security number

Date of birth

/

/

Date of birth

Spouse's SSN (only if married fi ling jointly)

/

/

2. Do you want $1 of your tax to go to the Ohio Political Party Fund?

Yes

No

If joint return, does your spouse want $1 to go to this fund?

Yes

No

Note: Checking "Yes" will not increase your tax or decrease your refund.

3. Enter the amount of your 2012 federal adjusted gross income from

IRS form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 (cannot

0 0

exceed $999,999).

4.

If you fi led a 2012 IRS form 1040A or 1040EZ, enter -0- on this line

because you are not entitled to this deduction.

However, if you

fi led a 2012 IRS form 1040, enter here the amount from line 10 of that

0 0

return. If line 10 is blank, enter -0-.

5. Enter the number of dependents, other than yourself and spouse, that

you claimed on your federal income tax return. If none, enter -0-.

6. Enter the amount of unpaid use (sales) tax that you owe from line e

0 0

of the use tax worksheet on page 33. If none, enter -0-.

7. Read the W-2 instructions on page Tel 3 before completing this

part. Enter your total number of W-2 forms. If you have more than

nine

W-2s, you cannot TeleFile.

Round all dollar amounts to the nearest dollar (do not include cents).

Employer I.D. number

State wages, tips, etc.

Ohio income tax with-

Indicate whether your

8.

9.

10.

11.

(box b, not box 15)

(box 16)

held (box 17, not box 2)

W-2 or spouse's W-2

00

00

Yours

Spouse's

1st W-2

00

00

Yours

Spouse's

2nd W-2

00

00

3rd W-2

Yours

Spouse's

00

4th W-2

00

Yours

Spouse's

00

00

Yours

Spouse's

5th W-2

00

00

Yours

Spouse's

6th W-2

00

00

7th W-2

Yours

Spouse's

00

00

Yours

Spouse's

8th W-2

00

00

Yours

Spouse's

9th W-2

Be sure that you entered on line 8 the employer I.D. number appearing in box (b) of your W-2. Do not

!

enter the I.D. number appearing in box 15. Also, be sure that you entered on line 10 the amount of your

Ohio income tax withheld appearing in box 17 of your W-2. Do not enter the amount of the federal income

CAUTION

tax withheld appearing in box 2. If box 15 on any of your W-2 forms shows a state other than OHIO or

OH, you cannot TeleFile.

- Tel 5 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64